What’s Driving Asset Managers to Automate Pitchbooks?

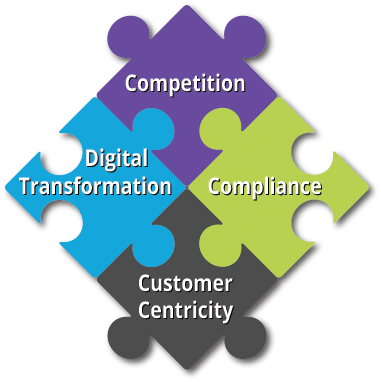

Why automate pitchbooks? Asset Managers recognize automating the marketing and sales process is required in order to be efficient, compliant, and competitive. The manual process of updating pitchbooks and distributing them to the sales force is an antiquated process. It doesn’t adequately serve salespeople or their clients and prospects. There are four main drivers influencing asset managers to automate this process:

Driver #1: Competitive Pressure

Firms are looking for ways to differentiate beyond product performance. It is no secret that client experience has become paramount in the effort to attract and retain assets. To create a great client experience, provide client-focused or “story-based” pitchbooks, as opposed to standard product-based facts and figures. It’s also about providing professionally packaged information in as close to real-time as possible. Automation is critical to accomplishing these two goals: personalization and speed-to-market. By creating compelling and engaging presentations quickly, the asset manager can improve win-rates.

Driver #2: Compliance & Risk Management

Historically, the majority of asset management organizations have trusted their sales teams to take generic product literature and to modify it on the fly to suit their audience. Pulling apart presentation decks, rearranging them, and adding non-approved pages were all fairly common practices. This strategy seems to be dying a rapid death due to a greater focus on the risk issues it creates. Even smaller firms we work with today are getting serious about controlling their materials and the message from a centralized vantage point. Having a managed repository for the most up-to-date sales and marketing content, and which enforces usage rules, greatly minimizes risk. If done well, this also enhances the sales team’s work as the content and rules are all systematized and readily accessible. In addition, new regulatory pressure stemming from the DOL Fiduciary Rule has increased the need to equip sales teams with more formal tools and more auditable processes. Groups affected include Independent Broker-Dealers (IBDs), Registered Investment Advisors (RIAs), Mutual Funds, and Insurers, as they are all looking for ways to adhere to regulations and ensure compliance.

Driver #3: Customer-centricity

Customer centricity is a main focus of the whole industry. This means different things to different people and thus will impact the sales supply chain. Without sophisticated selling tools in place, being customer-centric places a heavy burden on marketing, sales and compliance departments. In a non-automated marketing operation, the marketing team is often tasked with providing the sales organization with custom-tailored presentations, fielding daily requests and scrambling to assemble just what the salesperson says they need. This is usually enough of a resource drain that they set limits on who can receive a custom presentation or creates turnaround times that aren’t acceptable (or both). The end result: salespeople usually circumvent the system, creating their own presentations from a version saved on their desktop, causing risk to the firm from both a regulatory and brand compliance standpoint. In addition, this strategy almost always causes friction between sales and marketing organizations. Many firms who’ve taken this approach are running out of steam.

Driver #4: Digital Transformation

Firms across the globe are in the midst of undergoing digital transformation. It’s a very broad phrase that embodies a holistic approach to the way a business operates and serves its customers. Also, it’s the fourth driver influencing managers to automate. With regard to pitchbooks, it means firms are looking for ways to digitize the way they communicate information to clients. A pitchbook should no longer be thought of as a static 80-page printed document. In fact, it is a dynamic, digital storyboard that illustrates solutions to the client’s needs. This requires looking at the solution as an integrated part of the marketing technology stack. Accordingly, forward-thinking firms are approaching pitchbook automation as an integrated strategy encompassing content automation, sales enablement, compliance, CRM, and marketing automation systems. A holistic, integrated strategy will enable the firm to further streamline processes, aggregate analytics for business intelligence, and store information for compliance and auditing purposes.

Here are some related resources that might interest you:

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]