West-Coast TAMP Conquers their Complex Data Challenges with Automation

A west coast Turnkey Asset Management Provider (TAMP) was experiencing an operational challenge very typical of growing investment firms: fact sheet production inefficiency.

A west coast Turnkey Asset Management Provider (TAMP) was experiencing an operational challenge very typical of growing investment firms: fact sheet production inefficiency.

As with most investment companies, their first step in solving this problem was to start looking at fact sheet automation solutions. As their team dug into the issue, however, they realized that the root of their problem wasn’t their fact sheets, it was their data.

A great data strategy is vital to producing month and quarter-end reports in a fast and compliant manner. This TAMP was quick to recognize that in order to get their fact sheets out quickly without increasing risk, they had to start by refining their data management process. By using automation, the firm could improve their data quality and speed, thus using their data as the backbone of the their marketing and risk management strategies.

About the Firm

This turnkey asset management provider (TAMP) offers investment strategies, marketing support, and practice management to thousands of independent financial advisors, RIAs, and advisor teams. Their goal is to help advisors scale their practice and remove burdensome aspects of running their business so they can focus on building client relationships. This appeals to advisors who are building a fee-only business because they can avoid the cost of building their own fee-account platform. This particular firm is among the largest and most innovative TAMPs in the industry with now over $70 billion in AUM.

The Key Business Problem: Data Complexity

Back in 2013, the firm was experiencing substantial growth and success, adding strategies and solutions to their platform and increasing their base of satisfied clients. The firm’s Director recognized that in order to scale the business and continue meeting their SLAs, they must reduce the manual effort required to manage data and product fact sheets.

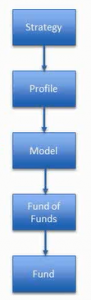

As with most investment companies, this TAMP is inundated with data. While many firms struggle with data management to some degree, TAMPs have a particularly complicated data management scenario. This TAMP has strategies that are composed of funds, funds of funds, and higher-level composite investments that can be up to 5 levels deep. This requires a great deal of source data to be aggregated and calculated. For instance, if they want to calculate class exposure for US Equity in a particular strategy, they first have to evaluate the strategy holdings. If those funds are multi-asset, they then have to determine the fund’s holdings. It required a very nested calculation done manually in Excel by a talented Analyst, which took anywhere from 40 to 120 hours to complete for each reporting period.

This created a few key issues:

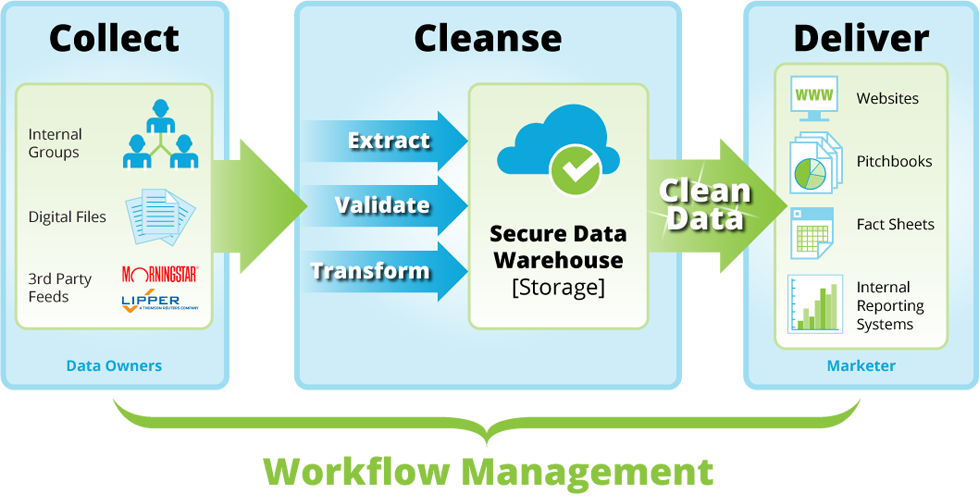

- Operational inefficiency: Data was arriving in non-user-friendly formats from many different sources including internal teams and strategists, external strategists from fund companies, and third-party data providers like Morningstar. Manual data aggregation and calculation of performance, holdings, characteristics, exposures, and other data points resulted in a complicated web of spreadsheets that was taking 40 to 120 hours to reconcile — a process only their analyst understood.

- Risk of error: Multi-asset model portfolios were manually created in Excel using holdings data that is constantly in flux. This process was not only inefficient, but prone to error. In addition, there wasn’t a good way to ensure that data was represented consistently from one document to the next.

- Inability to scale: The marketing team was copying graphs from Excel and pasting them into Adobe InDesign to create their fact sheets and performance documents, which wasn’t scalable. In order to grow, the firm needed to create a much more scalable process (automation) to support an increasing volume and variety of marketing materials.

Solving the Complex Data Problem: It Takes a Strong Leader

The Director of the firm had been charged with scaling the investment process and taking control of risk management. Finding the right automation solution was his first order of business. It didn’t take him long to see that data and content automation was the low-hanging fruit.

He began by engaging his team to gather requirements, which included:

- Flexibly data management functionality. They sought a vendor that could provide a solution for their exact data scenario. They needed a structured process and straightforward user interface that could offer insight into the status of the data coming in. They wanted a system that could produce quality data very quickly and make the data readily accessible for marketing and other core business functions.

- Flexible content automation functionality. This firm produces a wide variety of documents including quarterly strategy fact sheets, monthly strategy client performance documents, and quarterly fund manager fact sheets. These documents display multi-asset data, so it was important to find a flexible system that could produce visually appealing data visualizations to their exact specifications.

- Data quality, integrity, and usability. They needed a system that would give them confidence in their numbers to ensure that numbers were displayed consistently from one document to the next.

- Turnkey implementation. They wanted a system that could be customized to their exact needs without requiring a lengthy implementation phase.

- Service-enabled platform. The firm did not wish to support a local installation that would require maintenance by their internal IT team. They wanted a system that was fully supported by the vendor, including a team of client services experts with proficiency and familiarity with investment portfolio data.

Once the firm finalized their requirements, they began looking at third party vendor solutions. During the vendor selection phase, they sought to really understand the flow of the data as it enters the environment. In other words, how it is normalized, validated, stored, and then pulled into documents to render the final output. It was important for them to have a thorough understanding of the data lifecycle and workflow. This understanding was critical to their decision because they felt that the quality of the final output would be a direct result of the underlying solution architecture.

The Solution: Data Management + Fact Sheet Automation

After evaluating several providers, the TAMP selected Synthesis to implement a data management and fact sheet automation solution. The solution was deployed within two business quarters to meet their timeline objectives.

The Synthesis platform was tailored to handle their complex data needs using a highly flexible, yet structured, data model. Synthesis collects the data from a variety of internal and external sources in varying formats. Once the data arrives, it is validated and then calculated based on the client’s specific business rules. Once the data has been processed and approved in the system, it is fed into they Synthesis content automation platform. This provides content management, workflow, and automated production features to help the marketing team produce key documents and client reports in minutes. Documents are produced to their desired output (PDF, PPTX) and distributed in any format to any device or system required.

Key benefits of the new solution include:

- A central data management hub. A simple, highly user-friendly system is used for aggregating, validating, calculating, and storing data in its final, processed state. The entire process is structured and viewable via a central dashboard to provide visibility to the marketing team and other interested parties.

- Data consistency. There is one set of approved data that is used across marketing assets and client reports. Charts, graphs, and numbers are consistent from one document to the next.

- Marketing Automation. There is no longer a web of complicated Excel spreadsheets or the manual task of copying and pasting graphs into marketing documents. A majority of the process is automated. Human intervention is only needed to make approvals.

- Audit trails. There is a complete audit trail from the time the data arrives, through every step of processing, to when the data is consumed. The system tracks when files come in, when they are validated, how they are calculated when reports are run, and when changes are made and why. There is one system to reference to understand the lifecycle of every data point.

- Workflow management. There is a streamlined workflow that saves the firm time and money and minimizes their business risks.

The end result: beautiful fact sheets and client performance reports that are produced more efficiently with minimal risk. They have confidence that their data is correct and consistent across all marketing assets.

Reaping the Benefits and Realizing ROI

The firm’s portfolio management and marketing teams have both experienced the positive impact of their new data and fact sheet automation solution.

The TAMP’s data analyst estimated that the solution will save their team about 2,000 hours per year – equivalent to one full-time person dedicated to the effort.

The result is that the portfolio management team can focus on core business functions that drive the business forward, instead of pushing data around every quarter. With the time they are saving they can focus on analyzing and researching the investment management firms on their platform, devote more time to managing and enhancing the current investment process, research new topics, and create new investment solutions.

On the marketing side, they are now automating the production of 50 strategy fact sheets and a dozen monthly performance documents, which provide reporting by allocation approach and by strategy to show the performance of each profile and strategy.

After just one month on the platform, they have made significant strides in streamlining and scaling their operations, and have made plans to add more marketing materials to their automation mix in the near future, including dynamic pitch books.

For more details on this case study or to learn more about our automation solutions, get in touch!