Large U.S. Insurance Company’s Investment Management Group Doubles Output, Improves Speed-to-Market, and Reduces Costs

Summary

The growth-by-acquisition strategy of a Large U.S. Insurance Company’s Investment Management Group hinged on efficiently scaling up the production of quarter-end marketing materials. By implementing a fully automated solution, they achieved their goal of doubling output and reducing production time, while also cutting $58,000 in annual agency costs. This firm won an MFEA innovation award for their accomplishments.

The Opportunity

The marketing team spent as long as 30 days after quarter-end manually updating thousands of data points in hundreds of fact sheets, investment commentaries, pitchbooks, and other core pieces their advisors use to understand and sell the firm’s mutual funds.

The Solution

As a first step, the marketing leadership team conducted a Black Belt Six Sigma review of their content processes and identified that they could address these issues by implementing straight-through processing (STP). STP is an automated workflow that uses a single system to process all elements of a financial transaction including the front end, middle, back office, and general ledger — through fully electronic data transfers, with no manual intervention.

The firm undertook a three-year project to automate 4 main processes:

- Process 1 – Input source data

- Process 2 -Consolidate data into a single location

- Process 3 -Push-out data updates across marketing pieces

- Process 4 -Distribute content to the sales team

The dynamic publishing project was implemented in stages and included integration with the firm’s in-house compliance tool.

Results:

The team achieved multiple quantifiable benefits from the change.

Benefit #1:

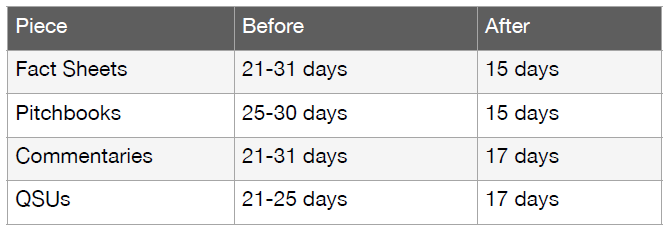

Cut time-to-market by up to 15 days, bringing delivery time frames for materials in line with competitors.

Benefit #2:

Reduced annual costs by $58,000 by eliminating annual agency costs of $24,000 for pitchbooks and $34,000 for QSUs.

Benefit #3:

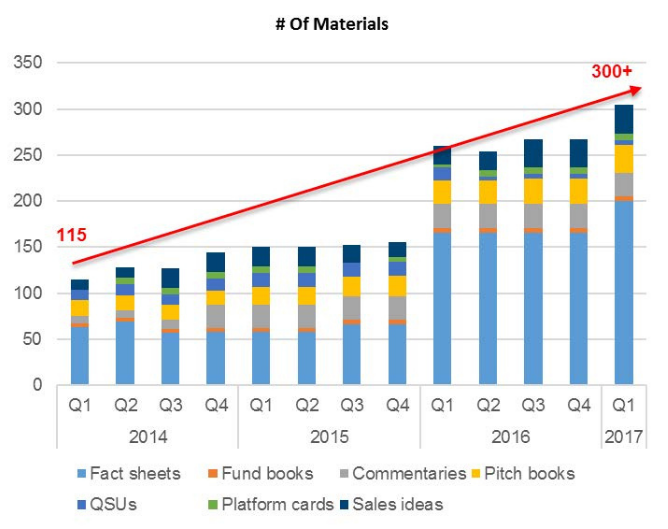

More than doubled quarterly fact sheet production and increased the total number of all pieces produced each quarter from 115 to more than 300 — without additional staff time.

Benefit #4:

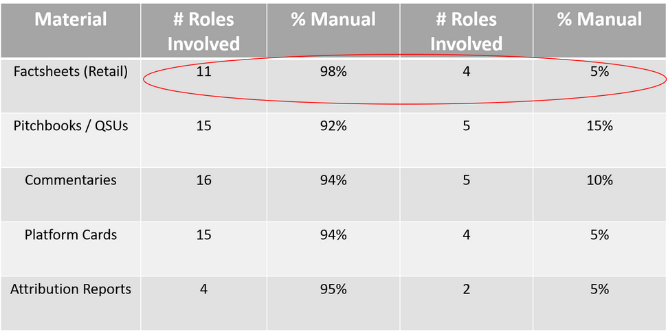

Eliminated more than 90% of manual effort, and cut the number of team members needed in the creation of each piece by 50%-66%.

Benefit #5:

Improved data integrity by streamlining data sourcing, incorporating clear accountability for data at each step of the process, and reducing the risk of errors.

Bonus Benefit:

Perhaps the most significant impact from implementing a fully automated solution was on the team’s strategic capacity. By significantly reducing the time-intensive manual processes required at quarter-end, the team was able to redirect their energies toward high-value marketing activities that directly contribute to driving revenue.