Tag Archives: Andrew Corn

Trends in Asset Management Marketing: What to Expect in 2017

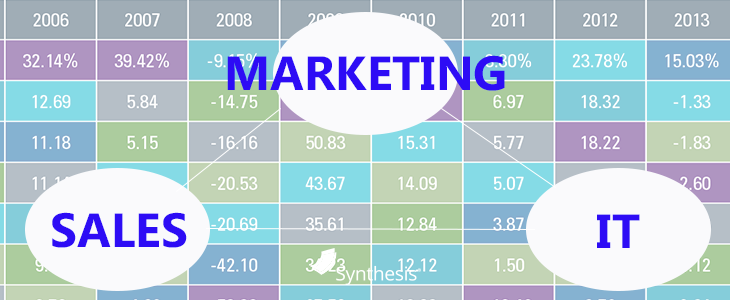

Last year, we published a blog on what to expect in asset management marketing in 2016. The post is based on an interview I conducted with Andrew Corn, CEO of E5A Integrated Marketing. During the interview, Andrew and I discussed how 2016 would be the year of transparency and immediacy; the year for asset managers to leverage data to improve segmentation and personalization, create more transparency in the sales process, and provide timely information to every audience, on every channel. At Synthesis Technology, we saw these predictions hold true. Many of our clients made significant improvements to their content delivery methods through strategic data and content automation.

Last year, we published a blog on what to expect in asset management marketing in 2016. The post is based on an interview I conducted with Andrew Corn, CEO of E5A Integrated Marketing. During the interview, Andrew and I discussed how 2016 would be the year of transparency and immediacy; the year for asset managers to leverage data to improve segmentation and personalization, create more transparency in the sales process, and provide timely information to every audience, on every channel. At Synthesis Technology, we saw these predictions hold true. Many of our clients made significant improvements to their content delivery methods through strategic data and content automation.

So, what will be the new trends in 2017? How will firms embrace data and technology to be even more competitive?

Once again, I called upon Andrew to mine his brain for insights. He is the former CIO of Beacon Trust and Clear Asset Management, where he led the development of a multi-factor model to manage long-only equities. He has also designed ETFs and managed two hedge funds. Today, he helps firms leverage digital media and technology to grow sales through marketing and advertising, while adhering to industry regulations.

Here is part 1 (of 2) of our discussion on what to expect in asset management marketing in 2017. (more…)

Trends in Asset Management Marketing: What to Expect in 2016

(To read our blog on Trends in Asset Management Marketing for 2017, click here.)

You know that guy who always has something interesting to share and teaches you something new in each conversation? The guy that always seems to have a pulse on what’s currently going on in the industry? Andrew Corn, CEO of E5A Integrated Marketing, is “that guy” for me. (more…)