Category Archives: Pitchbooks

7 Problems With Automating Factsheets In PowerPoint

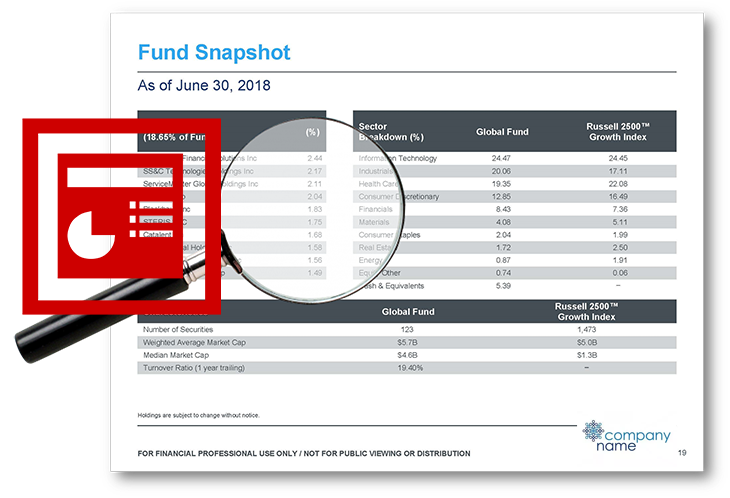

Maintaining a strong and positive brand image is more important now than ever. Every contact with a client and every piece of material they see from your firm needs to be professional, timely and well produced. Even something as mundane as a poorly produced factsheet can be off-putting and give an investor pause to think about the overall quality of your operations. Yes, even in the digital age, quality design and typography in printed materials really matters. That’s why automating factsheets in PowerPoint is a bad idea.

A long-time head of marketing for a major asset manager once said to me: “If you look at the most successful companies in any industry, you’ll find that they share one thing in common; excellent branding.”

Four, No FIVE things to Look for in a Content Automation Solution

I’ve written and spoken frequently in the past about what asset management firms should be looking for as they evaluate content automation for production of their templated literature; fact sheets, commentaries, sales ideas, pitch decks etc. Indeed, this article is largely an update of one I wrote in 2021. I feel compelled to revisit the topic today, however, because of one key thing that seems to be driving a lot of decision making in the market today.

The four things described in the original blog remain as on point today as they were in 2021: data source flexibility, data visualization power, real scalability, and integration capabilities.

The fifth item is hidden in the discussion of the original four and I feel it should be brought to the forefront. And that item is: the total long-term cost of ownership of the solution.

Read More

The SEC’s New Modern Marketing Rule: Are You Prepared to Comply?

You’re probably already aware of SEC’s Modern Marketing Rule (Rule 206(4)-1), which replaces previous rules governing advertising by registered investment advisers, including asset managers and private funds.

You may even know these rules are scheduled to go into effect on November 4, 2022.

But does everyone in your firm who is involved in communicating with the public understand the new requirements? And, more importantly, is your firm on track toward meeting these requirements?

If you’re not, you’re not alone. According to Red Oak Compliance Solutions, less than 25% of their clients admit that they’ve fully instituted processes for complying with Rule 206(4)-1.

The good news is that most print and online marketing and advertising materials that asset managers produce already comply with SEC requirements.

However, the SEC’s new rules are designed to close certain loopholes, particularly concerning the way performance information is presented, as well as encompass the reality that messaging platforms like email and social media have become as important as pitchbooks, and web sites in conveying marketing and sales information to clients and prospects.

And, if that wasn’t enough, the SEC will now require asset managers to provide extensive documentation of the processes they used to create, review, approve and distribute advertising materials.

Is there a silver lining here? Perhaps, since the SEC is finally going to allow asset managers to use client testimonials and endorsements in their advertising.

Let’s take a closer look at the key provisions that will create the most work for asset managers—and what they need to do now to comply with the new rules.

How to Tackle Investment Data Management and Content Automation Initiatives in Tandem

Insights by John Toepfer, CEO and Chris Ruppenstein, Director of Sales at Synthesis Technology

Today, nearly every segment of the economy is seeing an increase in wage pressures and tighter labor markets. As a result, asset management executives are looking to efficiently allocate resources amongst already capacity-constrained teams and business units. This means manual, time-consuming tasks should and must be automated.

Deloitte’s 2022 Investment Management Outlook report showed 45% of survey respondents see operational efficiency as a top driver for digitization. Similarily, Synthesis Technology’s 2021 Asset Management Martech survey also showed operational efficiency as a top driver in terms of Martech stack changes over the next two years (82%). And while most asset management firms have some automation in place, they still are not investing enough in data management solutions. Only 24% of responding firms reported having a data management solution for product data, and even fewer (13%) reported having an integrated product data management and content automation system.

The lack of efficient data processes negatively impacts managers’ efficiency, bottom line, and competitiveness. For example, taking a month after quarter-end to update and distribute marketing and sales materials is costly, puts marketing and sales teams at a disadvantage, and may lead to investors and prospects looking elsewhere.

Managers also face increasing data governance and compliance scrutiny from the due diligence requirements of potential investors and consultants as well as internal stakeholders.

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]