Category Archives: Sales Enablement

7 Problems With Automating Factsheets In PowerPoint

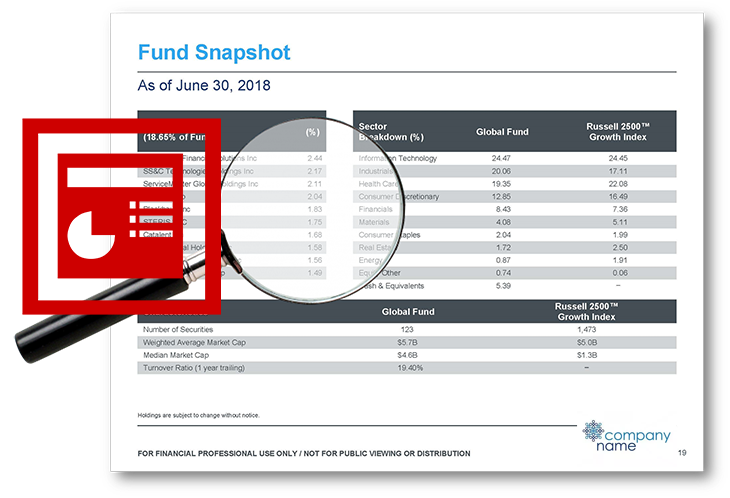

Maintaining a strong and positive brand image is more important now than ever. Every contact with a client and every piece of material they see from your firm needs to be professional, timely and well produced. Even something as mundane as a poorly produced factsheet can be off-putting and give an investor pause to think about the overall quality of your operations. Yes, even in the digital age, quality design and typography in printed materials really matters. That’s why automating factsheets in PowerPoint is a bad idea.

A long-time head of marketing for a major asset manager once said to me: “If you look at the most successful companies in any industry, you’ll find that they share one thing in common; excellent branding.”

The First Step To An Effective Pitchbook Strategy for Investment Managers

In the world of financial product sales, the quality of your pitchbooks can either make or break you. In order for salespeople to deliver great presentations, it’s important to have an effective pitchbook strategy that runs like a well-oiled machine. If your strategy isn’t refined, you run the risk of sending out sloppy presentations that can damage your brand image, or worse, result in non-compliance.Read More

Pitchbook Problems? 3 Ways Technology Can Help

It’s tough out there for investment management sales teams and only getting more challenging. Today, pitchbooks must be customer-centric, created or changed on a dime, on-brand, compliant and have digital output and tracking options. That’s like trying to make a delicious, vegan, gluten-free, nut-free, and sugar-free wedding cake in 10 minutes.

If that hits home, then this article is for you.

(If you didn’t find that amusing, you’ve clearly never tried to make a cake in 10 minutes.)

Upscaling Your SMA Distribution Efforts

Separately Management Accounts (SMAs) are on a roll. Traditionally designed to target the wealthiest individuals and families, defined benefit plans and endowments, they’ve often been treated as a niche product or a way for managers of mutual funds to manage multimillion-dollar portfolios directly.

Separately Management Accounts (SMAs) are on a roll. Traditionally designed to target the wealthiest individuals and families, defined benefit plans and endowments, they’ve often been treated as a niche product or a way for managers of mutual funds to manage multimillion-dollar portfolios directly.

But that’s changing. According to research from Cerulli, assets held in SMAs grew by 34% year-over-year from the first quarter of 2020 to the first quarter of 2021 and now command a 16% share of the $9 trillion held in managed accounts. Cerulli’s research also indicated that advisors planned to boost their usage of SMAs by 19% in 2022 while reducing the use of mutual funds by 12%.

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]