Trends in Asset Management Marketing: What to Expect in 2016

(To read our blog on Trends in Asset Management Marketing for 2017, click here.)

You know that guy who always has something interesting to share and teaches you something new in each conversation? The guy that always seems to have a pulse on what’s currently going on in the industry? Andrew Corn, CEO of E5A Integrated Marketing, is “that guy” for me.

Andrew is a former portfolio manager and fintech business owner who now runs a successful investment marketing firm. He’s intimately plugged-in to what’s going on at the intersection of investing, marketing, and technology. When I started to write an article on the upcoming trends, he was the first person I wanted to talk to. With his permission, I’m sharing the highlights of our discussion regarding his thoughts on this year’s trends and challenges in asset management marketing.

ET: What do you think are the biggest trends or challenges that asset management marketing will face this year?

AC: Transparency and immediacy will be the big trends.

Transparency means sharing lots of information — research, data, analysis, your outlook, etcetera. Asset managers need to do everything they can to gain trust. With the current volatility we’re experiencing in the markets, investors want to be reassured that things are being done to the best of everyone’s ability and with their best interests in mind. Transparency and consistent communication with investors continue to be a key concern.

Immediacy is the second big trend. We live in a world of intelligent apps and websites. We’re at the point where you can tap on your smartphone and summon a car, get a price, and track your trip every step of the way. That kind of “Uberization” is showing up in every facet of our life, including investing. Getting information in real time is the expectation.

These two trends are not going to go away. Many marketers within investment management firms are realizing there’s a lot of information to communicate. We need to tell people what we do, our investment process, and how great our team is. You can do this with an app, a thesis on how the index was created, or with more data. In every facet of the investment world, marketers are communicating these things and the manifestation of them is performance. For example, we did really well because we beat the large-cap index. Well, if you’re a small-cap, large-cap investors don’t care. We need to be sure we’re comparing ourselves to the right thing and then provide analysis. Like, yes, we beat the S&P 500, but we did it with twice as much risk, or with half as much risk, or with a similar amount of risk.

Whatever the answer is, your audience wants to know. They want data and general communications, and they want it as close to real-time as possible. These are all things that require technology as well as human solutions. Humans have to do the communications, and they may have to decide which calculations are relevant to each audience, but regardless of the information or data, it needs to be packaged in a world-class manner. The best way to do that is with technology.

ET: What kind of technology should marketers adopt to get and stay ahead? And on the flip side, what technologies are investors adopting to get real-time information?

AC: Your question addresses the two-sided coin here. First, how do we create it accurately, in real-time, and in a visually-pleasing way? Second, how do we disseminate the information? The answer to the first is automation. Automated systems are going to be more prevalent. Automation is not only is about speed, but about accuracy and reducing costs over the long-term. All three elements are very important. The key is having the right information quickly that’s geared to the target audience. Then, the information needs to be distributed however an investor wants it. If they want a PDF and to print it, they should be able to get it. Or, if they just want it on a website, they should be able to get it. If they want it fed into an app, they should be able to get it. This is a big challenge at a mid-sized investment management companies.

From a technology standpoint, we basically want one very clean database, a set of approved designs and branding, and then to be able to output to different media at the touch of a button. Or, even better, without having to touch a button — it just happens automatically. Once the data is approved and the words are approved, it should be pretty instantaneous. Again, an automation system is really good for that, and for those who still need things printed. That’s one of the reasons I mentioned the PDF, something that can be sent to a printer, digital or otherwise, or printed locally on someone’s color printer, black and white printer, and, of course, pushed to the website.

ET: You mention that investors should get information however they want it, which means marketers need to be more customer-centric. What are asset management marketers doing to understand their audiences/channels?

AC: Marketers need to decide, do we need to build an app? Do we need it now or in 2 years? Is it for a phone or a tablet? That depends on who your customer base is. Those apps are sometimes quite different. I come from both the investing and the marketing side, and people will hire my firm to help build a plan. The first thing we want to do is analyze their current investors and look at who they really want as their next investor group. Where do they want to expand? And then, of course, the big question is — and why? We do that using qualitative and quantitative analysis. You can look at your existing set. People will tell you a lot, focus groups, etcetera, but another great way is through data.

The problem with focus groups or buyer persona interviews is that often people say one thing and then do another. If you can observe investment behavior, you can collect data on their actual behavior and then line that up with what they said. There’s a bunch of ways of getting that done. Tools like Google Analytics are really not enough because you’re just seeing web activity. There are similar tools for apps, but you need to be able to distinguish between the different types of visitors you have. Who actually has money with you versus those that are looking versus those that are just doing research? The data portion is not a 1, 2, 3, but again, it’s very worthwhile because it is the exact truth of what people are doing.

ET: This is where marketing automation comes in. Financial Services firms as a whole seem to be adopting it and getting better at using it, do you agree?

AC: Yes, marketing automation definitely plays into learning buyer behavior. At my firm, we are constantly measuring investor behavior and potential investor behavior looking for what we call “identifying allocating behavior,” and then turning that data over to our clients to go close the new allocation. Within that data tells you basically what they’re looking at, how long they’re looking at it, so you can figure out what they’re truly interested in.

When people are offered 28 flavors of ice cream, I can assure you the ice cream store knows both intuitively and factually what the biggest sellers are. Using that analogy, you can really understand what kind of information is being used by who and how. That’s key when budgeting to determine what kind of automation systems you’ll invest in, and how to prioritize. It helps determine what becomes secondary and tertiary.

ET: How can marketing do a better job of enabling their sales force, increasing alignment? What do you see as the key things that marketing needs to be focusing on?

AC: I will break it into 3 categories.

The first is getting the data on behavior. To do that, you need an overall marketing program that is going to draw people in and then gauge their interest. The biggest deliverable that a firm like mine gives to our clients is a list of financial advisors or institutions that are interested based on their behavior about allocating to their firm. The marketing team needs to be able to deliver high quality leads with the associated behavior. For a salesperson, it’s the difference between shooting fish in a barrel versus having to cold prospect. This technique is underutilized.

The second is to figure out what’s really working in terms of driving sales. There are lots of MarCom tools that get made because “this is what we’ve always done.” Each firm needs to look at what’s actually working. Part of that is branding and creating awareness. Eventually, you want to get to a second tier of marketing, which is more direct and sales-enabling, so, you’re able to measure ROI. We haven’t addressed things like custom pitchbooks that are automated, so sales can go in and display data as of end of the quarter, end of the month, or as of close of market yesterday. That has a lot to do with the strategy, the type of client they are targeting. Do I want short-term or long-term investors? If I show data that’s too current, am I buying too much into immediacy? Am I encouraging the wrong behavior?

The third is scalability. Each type of manager and strategy needs to make these decisions strategically, and then be able to offer whatever the right answer is to their sales team — at scale. Those last two words are super important. If they know that there are 100 people interested in allocating, each one of them is going to have a different persona and a different mindset, investment goal, etcetera. As they call on them, they need updated, real-time, transparent materials that are going to be highly-compelling and differentiated to help them win new assets.

ET: Do you think the use of factsheets, pitchbooks, and sales presentations are going to change in any significant way?

AC: Factsheets may change somewhat, but a lot of things about them are not going to change. We talked about delivery and the input. I think that one of the things that can and should change through automation is the customization of factsheets. I don’t mean customized down to an individual prospect, but customized per channel. If, for instance, you’re distributing through one of the large wires or one of the major RIAs, and you’ve got a specific deal, customized information makes sense, perhaps even co-branded. Anything that you’re going to do and repeat, like setting up for different distribution partners, can be implemented quickly through automation.

Another trend is the ability to download different data. Everyone likes to see what’s on the Factsheet, but what if an investor wants to take some of that data and do their own analysis? The investor can reach out to the company, but there is also this self-service mentality of, “I want to find out as much as I can without revealing what I’m doing.” Again, the data is the data, so you might as well allow analysts who are looking at your funds to have the data. I don’t mean cut and paste where they have to print it out and type it in. Or, having a bar chart of performance over 3-years, or 5-years or 10-years. I’m talking about a button where the data is downloaded. That’s something you might see added to some websites, not for a retail audience, but for institutional audiences and financial advisors.

The other thing I’m anticipating is the ability to see custom time periods. We’re actually working on a website right now where the chart will be there showing data as of yesterday through inception, but we’ll allow the user, whether it’s a retail advisor or institutional, to change the benchmark, or even input their own benchmark.

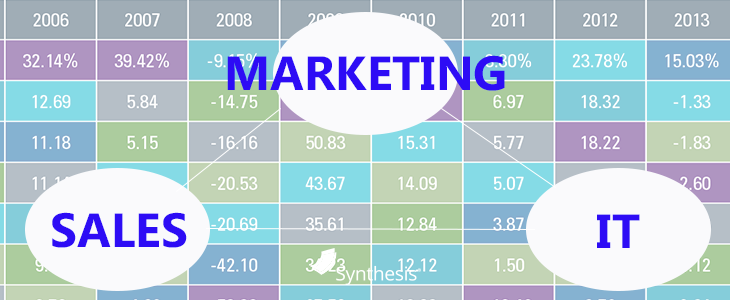

The other thing you might see is the ability to filter by custom date ranges. I think a lot of people want to see how you did in 2007 vs. 2008 vs. the last six months of 2009. I say that because people need to remember that at the beginning of 2009 we had the two worst months of the entire downturn. Even though that will not be downloadable, it will be viewable and printable.

Pitchbooks are a different animal, and we’re seeing more and more interactivity on the spot with live data. A lot of it is happening through slightly custom software on the iPad, and also through some available programs. Also, there are many ways to automate your slide library. The idea being that a wholesaler or a rep can choose what they want for each meeting and then send or present that custom file as well as download it.

Between Brightscope, GoToMeeting and other tools, we’re seeing a lot of it happen by internals on the larger firm sites. I know before I fly to another city, I’ll have already presented to the prospect on a GoToMeeting, Google Hangout or join.me. There are a lot of different tools.

On the pitchbooks side, that means making sure you’re designing within that framework of what can be easily understood, animated, does a video make sense or not? So there are considerations regarding delivery and also on the data side. Automation can help a salesperson create a custom deck quickly, helping them be more compelling and customer-centric.

Another aspect is integrating third-party data. Tools like Plan Sponsored Network from Informa, or eVestment give you deep analytics. They have some export tools into PowerPoint for presentation use. I think that those are going to be integrated and co-branded, meaning not just sourcing the data, but using the logo of the data source to obtain third party credibility.

ET: The pitchbook problem is one that marketing and sales have to work together to fix. When they’re thinking about using technology to solve this problem, what are the most important things to look at? You mentioned midsize firms, especially, are challenged by this because they don’t have the budget and resources to build a custom solution; they need to prioritize. What takes priority?

AC: As we said, data and other content need to be up to date. The most important thing a company can have is a process. For example, if I make a request that only marketing can handle which includes notifying someone in compliance that new content is available for review, there needs to be an indication of exactly what has changed so compliance can see what’s different. They shouldn’t have to read the entire page unless it’s for context. If all they’re doing is reviewing changes on two lines, the process needs to make it easy for them to sign off on it.

Once again automation really enhances the process and adds things like dates and time-stamps. Using a combination of good processes, people, and technology in the form of automation is what will really streamline these constant projects.

ET: What do asset management marketers need to do with their firm’s website to create a relevant client experience?

AC: This could be a full 1-hour response, but I want to just touch on a couple of key things.

One of the first things that really smart asset managers are doing is addressing each of their audiences individually. If I go into a party and someone is speaking in very large words, it may sound impressive to them but it may be off-putting to others around them. So, if I’m a consultant to an institutional asset owner looking for a ratio on downside volatility then the data and commentary I am seeking may make no sense to a retail investor. Segmentation may sound simple but to implement seamlessly remains challenging.

What we’re seeing is that marketers are really gaining this ability through what we call database publishing. There is a set of data, a set of words (maybe 2 or 3 versions of it), and depending on what page is being served to which audience, they are receiving what’s appropriate to them. If a very sophisticated investor is managing an overall portfolio to a risk budget, they might want to see what adding that little slice into their asset allocation will do. An advisor will have different needs, as will an individual investor.

Part of that is just seeing that the manager is saying, “Hey, I’m self-aware. I know what the effects of what I’m doing are. I’m concentrated. I have high conviction. Therefore, I’ve got more volatility, but there is a prize at the end.” Or “I’ve got a lot of securities and I’m tilted so I slightly beat the index, but I’ve got almost the exact same risk profile.” So, whoever your firm really is, you should own it. On your website, there are simple ways to use automation to speak to everyone in the best way.

ET: Let’s talk about data. How important is data management to overall speed and accuracy of marketing execution? Do you see firms making the right investments in investment data management?

AC: It’s interesting. What we’ve been seeing is that data scrubbing, data integrity, and data hygiene are all going from being geek terms and asset management terms, to also moving into the marketing side. If one wants to have the best analysis on the investment side, and you do a good job of it and the manifestation of all that work is good performance, then the best way to tell the world about it is to put that same effort into your marketing data.

The old expression “garbage in garbage out” exemplifies this in an exponential way. If there is one number wrong, then every calculation is going to be wrong. There is no such thing as a very small mistake with data, especially over time. Some firms are really getting it. It’s one of the reasons why some firms don’t get their factsheets out until 3, 4, or even 5 weeks after quarter-end. Again, these things can be checked, verified, uploaded, mapped and then put to different uses. Once that data is improved, it should be in a database to be drawn upon for the website, factsheets, pitchbooks, etc. Everything should be drawing on the same source. It’s easier and makes for great consistency.

ET: Yeah, absolutely. It’s interesting because many asset managers tend to minimize the data management problem. Usually, I think it’s because they don’t have time to deal with it, or don’t view it as their responsibility. If this is the case, how can marketers get the right access and visibility into the data immediately and leverage it for automation and more personalized marketing?

AC: If there is a disconnect between IT, marketing and the investment management side, the firm is going to miss out. So, if you’re not fast to market and accurate, it’s much harder to win. If you want to win and raise serious assets, then someone needs to light a fire under Performance Measurement, get Marketing the data they need, and teach them how to use it properly. Marketers can be intimidated by the data. Marketers need to understand what’s going on with the numbers and how they are most advantageously presented. When creating things like factsheets and pitchbooks, you’re going under the hood whether you like it or not. You (or your automation partner) have to be close enough to the data that if the automation made a mistake you can look at it and immediately know. You don’t want to send new materials to compliance more than once.

Everyone needs to be in sync, and marketers need to take ownership of the process. The truth is, the amount of money coming in is directly related to data quality and speed.

When I ran my asset management firm, I was working on my commentary two weeks before closing the quarter. I took notes all quarter long. Anyone who has played team sports knows, you keep a book on how you play that team. As a portfolio manager, all quarter you are keeping notes so that come quarter-end you’re ready to finalize your commentary.

ET: That’s a really good tip. Commentary is definitely its own animal, and a lot of firms don’t think they can automate it. They’ll say, “We just can’t get everybody on board to automate the commentaries. They don’t want to change their process.”

AC: There is not a portfolio manager in investment management, regardless of strategy or firm, who doesn’t have at least some of their bonus tied to their ability to raise assets and communicate. They have every incentive to cooperate if they understand. That’s a top-down thing. You do this right, you keep and gain new allocations, especially in the institutional world.

The more professional you run your business, the more it is a strategic advantage. If all things are equal on performance, I’m going to allocate to the firm that communicates the best and handles me in the most professional manner. Believe me, getting the materials out, what did you say — three days versus 10 business days — that’s a no-brainer advantage. The firm that is seven days faster is far more professional than the other.

ET: We talked about how this obviously affects sales, and ultimately AUM. But how does it affect client experience?

AC: I was about to jump on that. Imagine this. I’m a consultant with a midsize firm. I have $35 billion clients and a couple of whales (really big clients). This new firm is put on our platform, but we’re not ready to allocate. We’re watching them seriously, and their stuff consistently comes in cleaner and sooner than everyone else. What kind of impression does that make on me?

I will then say to other people in my firm: “These guys know how to run their business, not just their portfolio.” That is one of the biggest complaints right now. At all the conferences, people want to talk about operational due diligence. This is mostly about middle and back-office operations. It’s also about communications, reporting, investor relations, and of course timeliness and accuracy of materials.

The knee-jerk reaction is to send a spreadsheet as soon as it’s approved and plug it into the database. But, then, you lose your entire branding. You lose control of the communication. The whole reason people create pitchbooks and factsheets is so that they control the messaging.

ET: What should executives consider when deciding to build an automation solution in-house or outsource it?

AC: The most important thing is for marketing and sales to get together with someone from IT, investment management, and of course someone from senior management. They need to talk about what their end state should be. In other words, “Nirvana looks like this.” Then they can plan, and determine the steps to get there.

Each team member knows how to get it done once that process is in place. Each management company will be different in terms of whether it’s a total outsource, or just certain facets. They may build the data warehouse themselves because they need it for a variety of reasons.

The database may be done in-house, but why reinvent the wheel when there are vendors who have done this 25 times? The old expression, “everything is easy when you’ve done it before, it’s even easier when you’ve done it 25 times.” If the firm has a plan and they implement it over time and with the right partners, they are going to wind up in a very good place.

When someone is designing an automation program for their firm, that’s when to think about their branding and content strategy, too. It’s the time to ask questions like: Is this really what we want to display data? Investment process? Colors? Fonts? Does this belong on the page? Who is using this? Does this make the most sense for me, for my firm, my prospects, and my funds?

Designing your end state around the needs of your distribution channels makes common sense and business sense.

~ Thanks for reading! You can connect with Andrew Corn on LinkedIn, Twitter, or at E5A Integrated Marketing. You can also read our interview: Trends in Asset Management Marketing: What to expect in 2017.

Want to know what senior marketing leaders from top asset management firms are saying about marketing effectiveness? Get insights and takeaways from our Annual Marketing Roundtable Event. Download your copy of our 2016 Roundtable Report.

Here are some related resources that might interest you:

From the Blog: 7 Problems With Automating Factsheets In PowerPoint |  From the Blog: 3 Factors that Complicate Factsheet Automation |  From the Blog: How much does it cost to automate factsheets? 🧐 |

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]