Asset Managers Describe Disclosure Management Processes as ‘Cumbersome’ and ‘Risky’

New SEC regulations like Form ADV and N-PORT are putting even more pressure on registered investment companies to examine their regulatory enterprise risk management practices. Fund Operations reported that “RICs need to embrace the mandate of the new regulatory initiatives and proactively develop, implement and maintain robust Regulatory ERM systems to comply with…reporting obligations.”

As regulators continue to amp-up their scrutiny, many asset managers are taking a hard look at how they’re managing disclosures.

The status quo for disclosure management leaves much to be desired

Synthesis has been following this topic in 2016, conducting informal research on current disclosure management practices at investment companies.

We’ve found that many firms are using poor systems, but they also recognize that they need to improve. At most firms, these processes involve some combination of meetings, emails, and the sacred “master document” to manage and share disclosure language among different groups. Some firms have made progress, using sophisticated spreadsheets and coding systems or custom software. But on the whole, the marketing and compliance professionals we talked to say their current processes are cumbersome and risky.

Marketers say they are bogged-down by inefficient disclosure management processes

Almost every marketer we spoke to said their current process needs improvement. One marketer described their process as “clunky”.

“There is an 500-row excel spreadsheet housing all of our disclosures. Compliance updates it and sends out a mass email with the updated sheet. Changes are highlighted and we have to manually cut and paste the new disclosures from the spreadsheet into our website CMS and then send them to our data group for inclusion in an XML feed for factsheet automation. There are a lot of steps that could be streamlined; it’s very clunky.”

Marketers also say that changes in the disclosure language often aren’t clear. One marketer from a large global asset management firm said, “Identifying changes is difficult. We have to read word-for-word to see what changed if it isn’t clearly called out. With disclosure language changing on a regular basis, it slows us down when we can’t easily see what changed.”

Cumbersome processes lead to inconsistencies in the disclosure language, putting asset management organizations at risk

The length of disclosure language is continually a problem for marketers — real estate is scarce on those fact sheets! When marketers suggest changes to shorten the language and re-submit to Compliance for approval, this may create two different versions of that disclosure across the communication matrix. One marketer said, “When business rules aren’t clear, things are left up to interpretation, such as when a disclosure should be used based on what’s being shown. That presents a risk.”

In addition, many marketers told us that too much of the disclosure burden is placed on their teams, and think the ownership should lie with Compliance because they are the subject matter experts.

From slower time-to-market to inconsistencies, marketers have long been proponents of improving how disclosures are managed, as it can only make their lives easier.

Compliance teams want to improve the process, too — and they should

Compliance and risk management departments are the main drivers of disclosure management upgrades, for obvious reasons. One Compliance professional told us their biggest pain point is simply being the center-point of the disclosure management process.

“There are a lot of sources involved and a lot of fingers in the pie. We’re taking in information from FINRA, sub-advisors, and legal, and then trying to get disclosures out to the right people from marketing, product, tax and treasury, and other groups. Then, those groups sometimes want changes.” It’s managing these changes that causes the most risk, as there can be a break-down somewhere in the communication.

Another issue from the Compliance team’s point of view is distribution of disclosures. Often, Compliance relies on remembering who should receive which disclosures and how. This creates the problem of key man risk. This information should not be housed in someone’s brain.

Overall, it is apparent that in most cases the process is almost entirely manual with no clear, auditable system. However, the good news is that many Compliance teams are proactively looking for ways to improve and maintain in good standing with the regs. We found that the large, global financial organizations with complex compliance profiles are showing the most urgency.

Technology can streamline the process and reduce risk

Many firms are already using some form of automation for aggregating and validating data, as well as producing sales, marketing, and client communication materials, but a missing piece seems to be the ability to wrap disclosure management into those existing processes to further reduce the risk of non-compliant communications going out the door. Right now, most firms are manually managing disclosures outside of their automated web or print (PDF) production process, which is not best practice and it’s counterproductive. Firms that integrate robust disclosure management technology can improve enterprise regulatory risk management as well as speed-to-market of communications and reporting.

So how should the technology work? One marketer described their ideal process as “someone owning a central location or system, not a document. When updates are made, marketing would not have to do anything, our documents would just link to the database. Marketing needs to have control over how the language is rendered on the page, where it’s located, and the size. Further, this database should be centralized for the whole enterprise to benefit from. It’s not just the marketing team that prepares and sends-out public-facing communications.”

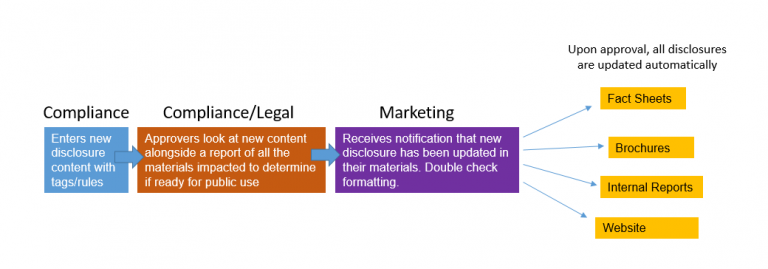

This ideal can become a reality when a disclosure management system is put in place and is well-integrated into the firm’s overall program. The benefits go beyond just making things easier for marketing and compliance; it can enable the entire enterprise, as any group (or other technology platform) that manages or uses disclosure language can be plugged into the workflow. Here’s just one use-case (example):

Disclosure management is an important aspect of a holistic regulatory enterprise risk management strategy, and we encourage firms to look at the broader picture to maximize their efficiency and keep costs low. If you’d like to learn more about global disclosure management, feel free to get in touch. We’d be happy to give you some input on improving your current process.

Here are some related resources that might interest you:

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]