Category Archives: Disclosure Management

Why Firms Automate The Investment Data Processes

Asset management firms that don’t automate the investment data processes pay the price every quarter in the form of time-consuming manual work, as well as the risk of human errors. The costs – including the opportunity costs – add up significantly over time. At a recent webinar, we explored how asset managers can get off the quarter-end hamster wheel forever and achieve long-term ROI through effective data automation. Below are some highlights from the conversation.

Why Efficient Marketing Compliance Processes Help Avoid Hefty Fines & Needless Back and Forth

Guest Post by Amy Watson at Red Oak Compliance.

Asset Managers are heavily focused on bringing in new business and attracting the right clientele. Compliance, while important, is something you’d prefer to have running smoothly in the background rather than disrupting your day-to-day flow.

However, an increase in hefty fines throughout the asset management industry means compliance needs to be front-and-center. To make the most of your resources and to ensure you’re not caught by surprise when regulators review your materials, you need to ensure you’ve built efficient, compliant processes that are easy for your team to understand and comply with.

One particular pain point we’ve heard about from clients: keeping sales team collateral up to date and books and records compliant across an organization.

Content Automation: A Competitive Necessity

Content automation has become a necessity, rather than a luxury, for most asset managers in today’s highly competitive environment. According to a survey of asset managers by the Fuse Research Network and Synthesis Technology, 95% of respondents use some kind of tool or process for automating content production. Most commonly, they use it for the creation of factsheets and pitchbooks.

The need for content automation is justifiable. Marketers need to get sales and marketing materials in the hands of salespeople, clients, and prospects as fast as possible. Now, investors, advisors, and consultants expect more frequent and timely product updates.

When implemented successfully, content automation solutions empower firms to produce fully compliant, client-ready sales and marketing content faster than their competitors. These tools reduce labor costs and relieve talented marketing professionals from the drudgery of content production. They minimize the potential for human errors that inadvertently deliver inaccurate and non-compliant information to the public. Plus, they eliminate one of the most common compliance headaches many asset managers face: keeping salespeople from stitching together their own non-compliant pitchbooks from a patchwork of outdated sales presentations.

Effective content automation solutions require two components: An in-house or commercial production tool and a reliable source of product data to populate the finished pieces. Unfortunately, data management is content automation’s Achilles heel for many firms.

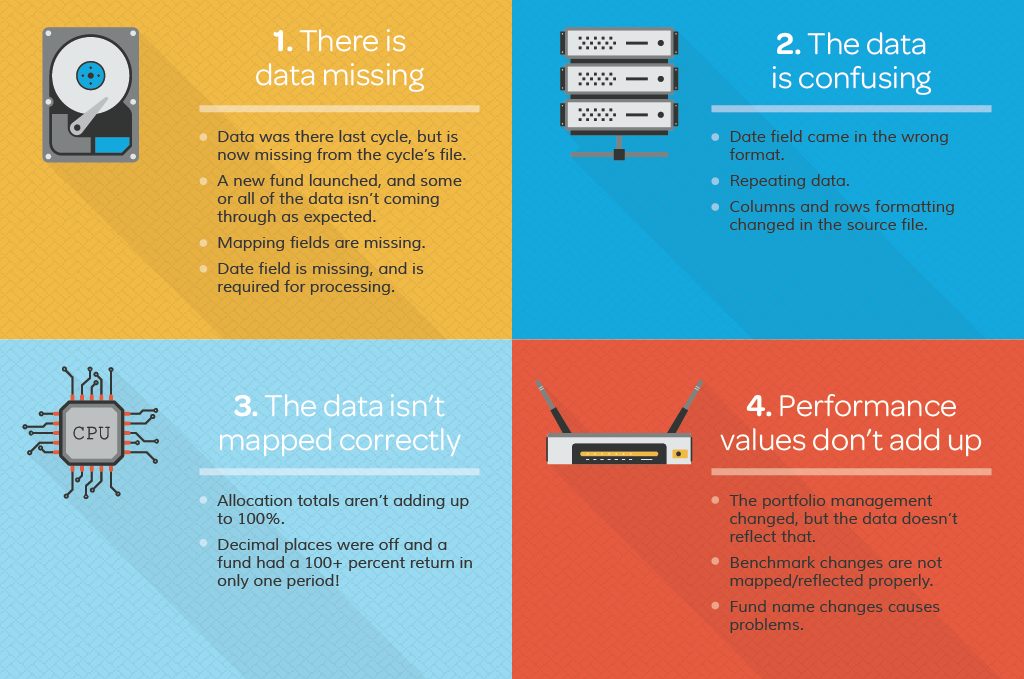

Fund Data Automation Solves Four Common Data Problems Faced by Fund Marketers

A few common phrases we hear from investment marketers are, Our financial data is a bit of a mess and Our data could use a little housekeeping. In our experience, we have learned that marketers have become the de facto experts on fund data management and automation.

Fund marketers themselves are routinely chasing-down their financial data from many disparate sources, both internal and external. Then, they are trying to extract clean data for use in their customer-facing marketing materials. This process is made more challenging when there are tight time frames. Plus, it has to be done with the highest levels of accuracy and consistency in real-time.Read More

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]