10 Best Practices for Tailored Shareholder Report Design

In our recent conversations with fund companies, we have been pleased to hear that the teams managing Tailored Shareholder Reports are taking this new SEC mandate as an opportunity to enhance their brand.

The detailed ins-and-outs of branding and branding-adjacent tasks can be unfamiliar to fund administrators and the teams involved in the regulatory and client reporting side of the investment management business.

Luckily, it’s not rocket science.

It is simply a process that helps to keep the firm’s look, feel, and messaging fresh. A rebrand can also be used to align a firm’s outward appearance with evolving trends, compliance needs, fund acquisitions, and/or strategic objectives. Rebranding can range from minor color and font changes to a complete overhaul of design and components – all things that must be accounted for in Tailored Shareholder Report planning.

However, in order to ensure all of these components are reflected in the TSR, an effective document design process is essential. Here, we offer a few of our best practices for creating a truly eye-catching and brand-defining Tailored Shareholder Report:

Overall Design: Designing any data-driven document (including TSRs) is a balancing act between aesthetics and functionality.

Leading firms in the industry are taking care to design TSRs that draw from the overall branding and aesthetic of existing marketing materials.

Readers moving between documents downloaded from the same website should experience each as part of a holistic literature collection. Headings, column structures, colors and the styles applied to charts and graphs should all be reasonably well-synchronized.

Create Sample Documents: Samples created to evaluate and finalize a design need to be realistic… and designed to accommodate typical and extreme use cases.

These include young products with minimal data, products requiring additional content or disclosures, and/or documents from different product lines.

Capturing these variations in the planning stage will reduce multiple risks often encountered at the implementation and client use stage of the effort.

Use Real Content in Mockups: Closely related to the above topic, we highly recommend using real data in document mockups. Latin content (i.e.: “lorem ipsum” placeholder text) will conceal the types of fit and finish issues alluded to above.

How the pages and components should use up or allow space when they grow or shrink due to product or data differences are important issues to manage during planning.

Page Layout: Be cautious with horizontally aligned elements, as they can create design challenges when accommodating real data. Stack text items into columns to maintain visual order and flexibility.

Dynamic Shuffling: Ensure your designs allow dynamic shuffling of components without unnecessary constraints, making future adjustments easier.

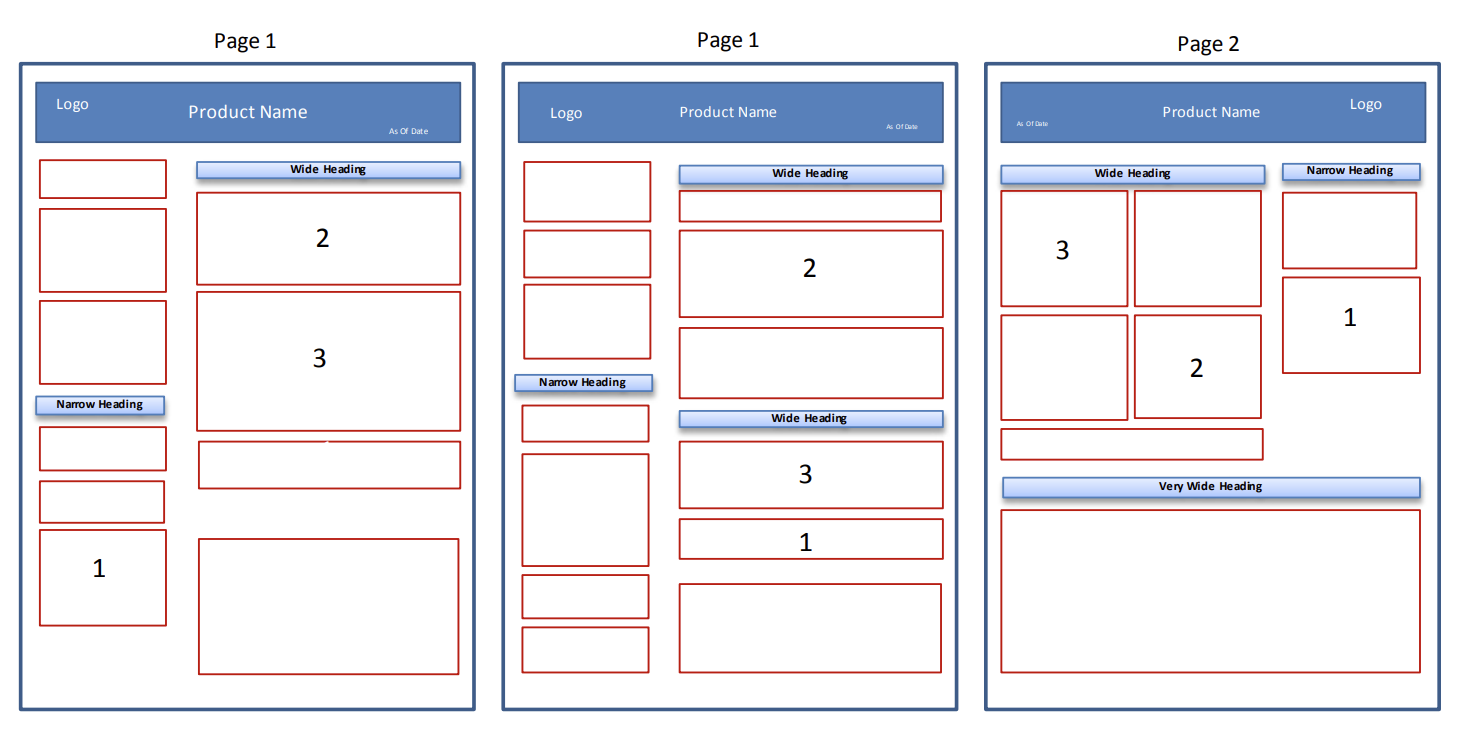

What does this mean? See the wireframe diagram below. It illustrates how components in a smart template can move around between columns and even pages based on best fit scenarios.

Component #1 fits in the left column on the first page template model but gets squeezed to the wide column in the second one. In a third example, it has been pushed to a narrow column on Page 2.

This type of component shuffling takes place all the time in catalogs of documents such as product fact sheets and is perfectly suited for tailored shareholder reports as well.

Style Guide: Provide an actual style guide with detailed specifications on font, spacing, gaps, margins, color, and alignment. Avoid guesswork and interpretation to streamline the implementation process. Relatedly, ensure that detailed style information is available at the project’s outset.

Copy Fit: Work with disclosure materials to determine word count targets and placement. Consider space limitations and variations in data content.

Testing: Schedule a thorough test print with different color variations before the live production cycle to identify and resolve issues related to crops, bleeds, overprints, font and color fidelity, and file transfer methods.

And even though the SEC mandate is for physical printing and snail mail delivery, it is important to ensure electronic color compatibility with electronic devices, such as iPads, as well.

Proofing Assistance: Engage individuals from other workgroups for final document checking and proofing to minimize errors.

Timeline Management: Designating an executive or manager responsible for timeline management is crucial. Plan your timeline carefully to allow sufficient time for testing and issue resolution, minimizing challenges during production.

In the end…

Applying a “rebranding mindset” to Tailored Shareholder Report design can help fund accountant teams to stay organized and ensure the project moves smoothly from one step to the next.

While we believe strongly that partnering with a document automation provider with longstanding experience creating and publishing data-driven documents can enhance the process, adhering to these ten best practices can help to minimize avoidable errors and result in a better end product.

A well-planned timeline, the provision of layout and style guides, and rigorous testing are essential components of a successful TSR project.

Here are some related resources that might interest you:

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]