Category Archives: Global Marketing Operations

Print is Dead, Long Live Print!

I’ve been in the computer-driven publishing industry my entire working life. For better or worse, that’s going on 30 years and six firms worth of experience building and selling systems to support the print (or print-like) communications needs of large businesses selling or supporting high-value goods and services. I’ve worked with Airlines, Pharmaceuticals, Auto Parts, Reference Publishers, Military, and Financial business. All have significant data-and-rules driven content publishing needs, including well-designed print artifacts. Supporting publishing in the financial services world makes up a majority of this experience, but we gain wisdom by understanding similarities and differences between multiple business sectors and markets.

For 87.3% of my long and illustrious career in supporting print communications, people have taken the position that Print is Dead… or soon will be. While there are specific examples and versions of this narrative that are true, I’m here to talk today about where and why it is not true!

For Asset Managers, The Profit Is In The Relationship

The economic pressure that has weighed down asset managers recently will continue to mount in 2019. We will especially see this as the tide of market-induced asset growth subsides. The established industry trends are rising passive inflows, fee compression, increased regulation, continuing platform rationalization. These are inescapable, threatening profit margins of the least prepared asset managers. In response, firms are intensifying their efforts to streamline distribution costs, improve their offerings, and invest in relationships. However, many still fall short of differentiating themselves among financial advisors. This could be the ultimate key to sustainable profits in this shifting landscape.

Key Takeaways From Our 2018 Factsheet Production Study

In 2018, we conducted a Mutual Fund Fact Sheet Production Study, where we analyzed 235 factsheets from 47 asset management firms of all shapes and sizes. A few factors observed included publish date, modification date and how the file was produced. The two most observed methods were using automation and producing factsheets manually. To find the firm’s production method, we turned to the metadata to show us what applications, software, or tools they were using to create the PDFs. After digging deeper into the metadata, we identified some key reasons why firms have longer production durations or later release dates. We were also able to make some observations about what drives efficiency, and the findings were pretty shocking. Read on to get the scoop!

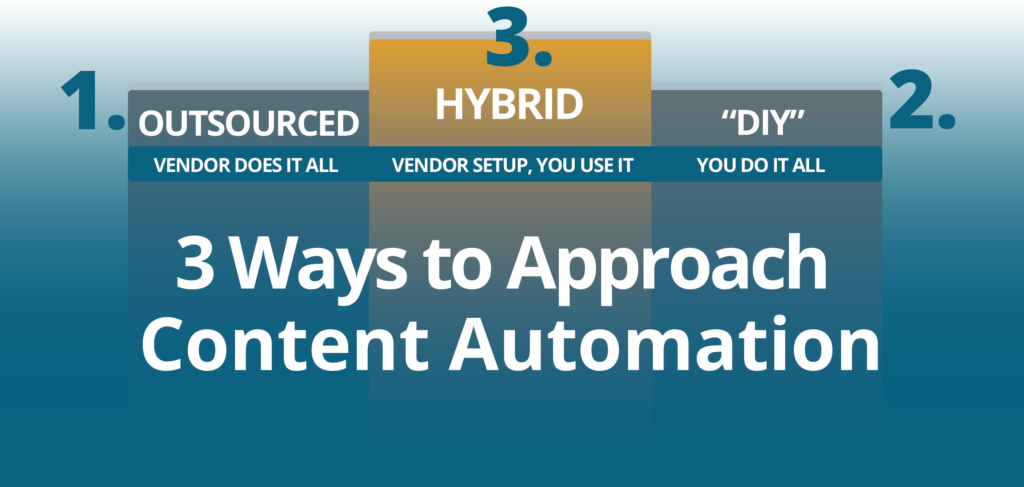

The 3 Ways to Approach Content Automation

Due to the competitive nature of the financial services industry, content automation has become a strategic priority for many. With a finish line goal to improve scalability, risk management and brand compliance, the race is on to improve marketing and sales operations. The challenge firms face is knowing how to approach content automation. Is it better to build or buy? What are the differences between the leading vendors, and their approaches?

In 2017, we commissioned some research on how asset managers are automating content production. The research found 3 common models: Fully outsourced, DIY, and hybrid. Here’s a brief description of each and the pros and cons.

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]