3 Ways Investment Marketers Have Adapted in 2020

The status quo is no longer good enough for intermediaries and investors. Investment marketing strategies have and will continue to shift since the COVID-19 pandemic. Then again, if you’re a forward-thinking marketer, I didn’t need to tell you that.

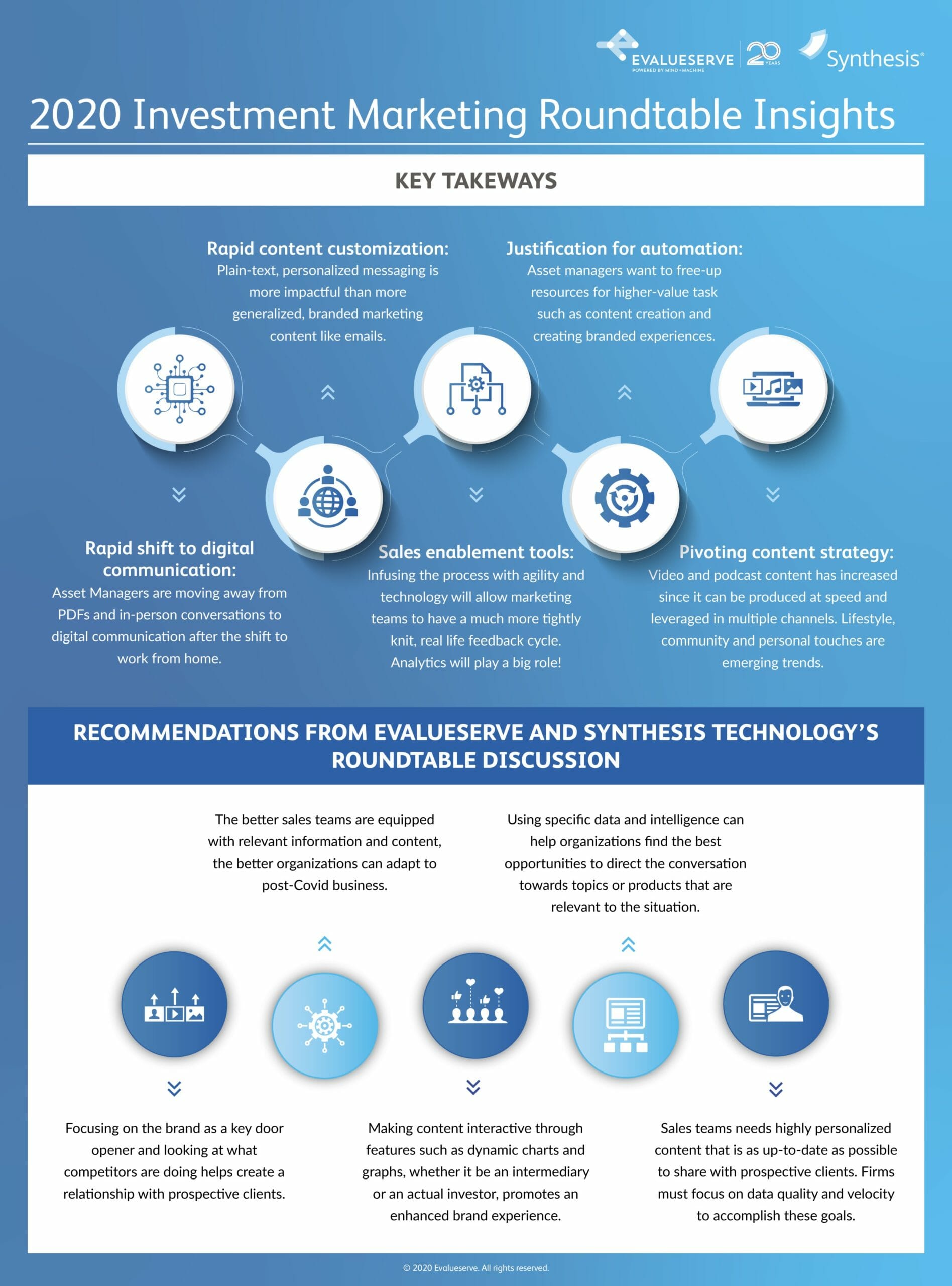

Synthesis and Evalueserve recently kicked off our quarterly private marketing roundtable series. We met with senior marketers from top investment management firms. Marketers shared their experiences, challenges, and ideas for success in our post-Covid environment. Since the pandemic, managers are figuring out how to step up their game to deliver customized and timely information to investors. So, marketers are reevaluating sales and marketing initiatives to remain competitive in a digital world. What does digitization mean for asset management marketers, and how can they efficiently achieve this? Marketing departments need the strategies, tools, and resources necessary to enable sales teams for success.

New ways to engage with investors

Investment marketers produce hundreds of items a month for financial advisors. Generally, most of this content has been sent as a PDF. While PDFs are still part of the mix, teams are using them differently to provide meaningful user experiences. Specifically, they are looking at ways to use them to integrate more of the digital communication strategy, like providing interactive factsheets and adding social media icons. In this digital and post-covid world, firms are moving away from static materials and looking to engage clients in a more interactive and personalized manner. This poses two opportunities for sales and marketing teams.

First, sales teams are finding new ways to connect with clients in a virtual world. The adoption of social selling and video use has increased exponentially in 2020 and are great ways to engage with investors. For example, firms are using a phone to record a quick, informational video and then posting to social media. In turn, the video rapidly reaches more investors than written content. Also, that video sets firms and people up as thought leaders and opens the door for new relationships. In our WFH environment, these raw videos have become an acceptable form of real human communication.

Second, marketing teams no longer have to ask “pretty please” for technology, because Covid justified the business ask. Investment marketers must provide sales teams with resources in a timely and custom way. Therefore, many firms are investing in software that streamlines data and processes to support sales efforts. Efficient solutions enable salespeople to reach more investors and build authentic relationships, which ultimately increases revenue.

Enabling investment sales teams

Sales and relationship management teams want to be the conduit. To be so, they need content from marketing, and they need it fast. This content includes email messaging templates, personalized pitchbooks, and engaging videos, to name a few. A big pain point for asset managers is not having centralized content to enable distribution. Questions sales and relationship management teams often ask include:

- What marketing assets do you have?

- Where can I find the content?

- How do I use the content?

- How can I leverage assets more effectively?

Asset managers pivoted their resources and budget to place a focus on timely, customized content production and branded experiences. Marketing teams are freeing up resources for content creation. Unfortunately, for many, this means a LOT of manual work. One way firms are lessening the workload is by investing in automation.

As mentioned above, the cost justification for automation has been made easier because of COVID coupled with growing attention toward regulatory standards like ADA Compliance. Another change noted by the group is that some firms are moving away from giving salespeople free rein to do hunting on their own. Instead, firms are leveraging data and analytics to narrow the universe for salespeople so they’re having very targeted, productive conversations. One marketer from a large U.S.-based asset manager said, “We’re at a point where we can get a sense of what’s going on at a branch or an office, like which asset classes and competitive products they’re using. We can narrow it down to which branch to call today and which products to talk to them about.”

Related: 8 Data Best Practices For Investment Marketers

A new, holistic customer engagement model

It’s clear that COVID disrupted the wholesaling model, and marketers are looking at ways to pick up the slack from a client experience perspective. There’s still tremendous value in connecting with a real person, but the way that personal connection occurs has changed. This will involve breaking down the silos between marketing, sales, and client service and utilizing technology to engage the customer at every stage of the lifecycle.

Marketers have a lot of technology at their disposal, but some struggle to figure out how to effectively integrate the stack and interpret the resulting data. We learned from this roundtable that marketers want to make 2021 the year they really figure out how to unify their technology strategy around the customer. The key initiative is integrating key technologies used by marketing, sales, and service teams to personalize the customer experience.

Investment managers are responding by building out their digital marketing and data analytics teams. One marketer mentioned her firm is going to double the number of data analysts next year to effectively tackle the data analysis problem. There are many different routes to take, but ultimately only one destination. Delivering the best experience to investors will remain the highest priority. Post-Covid, investment marketing strategies will never be the same, and I’m excited to see what 2021 has in store.

Let us know if you’d like to be considered for our next quarterly roundtable! You must be a senior marketer or partner (IT, Sales) for a mid-large asset management firm.

Here are some related resources that might interest you:

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]