Trends in Asset Management Marketing: What to Expect in 2017

Last year, we published a blog on what to expect in asset management marketing in 2016. The post is based on an interview I conducted with Andrew Corn, CEO of E5A Integrated Marketing. During the interview, Andrew and I discussed how 2016 would be the year of transparency and immediacy; the year for asset managers to leverage data to improve segmentation and personalization, create more transparency in the sales process, and provide timely information to every audience, on every channel. At Synthesis Technology, we saw these predictions hold true. Many of our clients made significant improvements to their content delivery methods through strategic data and content automation.

Last year, we published a blog on what to expect in asset management marketing in 2016. The post is based on an interview I conducted with Andrew Corn, CEO of E5A Integrated Marketing. During the interview, Andrew and I discussed how 2016 would be the year of transparency and immediacy; the year for asset managers to leverage data to improve segmentation and personalization, create more transparency in the sales process, and provide timely information to every audience, on every channel. At Synthesis Technology, we saw these predictions hold true. Many of our clients made significant improvements to their content delivery methods through strategic data and content automation.

So, what will be the new trends in 2017? How will firms embrace data and technology to be even more competitive?

Once again, I called upon Andrew to mine his brain for insights. He is the former CIO of Beacon Trust and Clear Asset Management, where he led the development of a multi-factor model to manage long-only equities. He has also designed ETFs and managed two hedge funds. Today, he helps firms leverage digital media and technology to grow sales through marketing and advertising, while adhering to industry regulations.

Here is part 1 (of 2) of our discussion on what to expect in asset management marketing in 2017. Read More

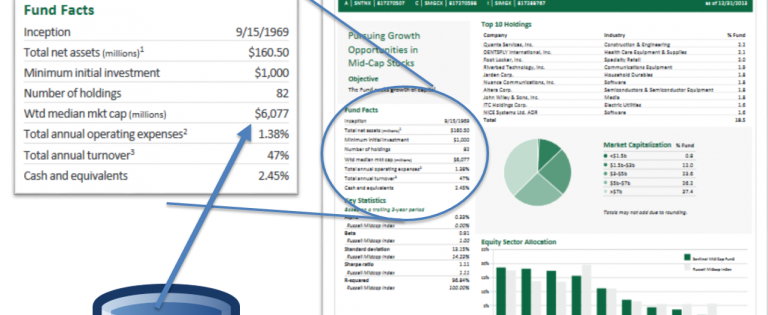

Business Rules: What They Are and Why You Need Them for Investment Marketing Content Automation

Hi, I’m Kim Rebecca. Throughout my career in the global asset management industry, I’ve had the opportunity to help facilitate data-heavy content automation. I’ve done this on thousands of regulatory documents, marketing collateral, presentations, web pages and so on. Actually, it’s probably hundreds of thousands. One of the key advantages of content automation is the accommodation of the ever-expanding scope of distribution. It allows product marketers such as myself to bolster their bragging rights. I’ve had the good fortune to help three global asset managers with their content automation efforts — prominent and well-recognized firms managing assets galore. I was thus somewhat surprised to find that a common challenge in the implementation phase of all of their automation was something seemingly basic: the identification and articulation of something called business rules.Read More

The Investment Management Marketing Conundrum

As is often the case, it’s what people do, rather than what they say, that’s most telling.

Let’s get this out of the way early.

If an investment manager

- does good work

- has responsive client service, and

- keeps a decent track record

then there is no reason why they should struggle to grow their assets under management.

If they do, then the problem is the marketing. Full. Stop.

But it’s not because investment management marketers don’t get it – they do. The problem is that marketing is either poorly understood or severely undervalued by the portfolio management team/firm management.Read More

Asset Managers Describe Disclosure Management Processes as ‘Cumbersome’ and ‘Risky’

New SEC regulations like Form ADV and N-PORT are putting even more pressure on registered investment companies to examine their regulatory enterprise risk management practices. Fund Operations reported that “RICs need to embrace the mandate of the new regulatory initiatives and proactively develop, implement and maintain robust Regulatory ERM systems to comply with…reporting obligations.”

As regulators continue to amp-up their scrutiny, many asset managers are taking a hard look at how they’re managing disclosures. Read More

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]