‘The fast fish eats the slow fish’ and the definition of insanity

Insanity is doing the same thing over and over and expecting different results.

Without a doubt, we’ve all fallen victim to “insanity” at different points in our lives. For example, I’m insane to think I can win a 5K race by training for distance with no regard to speed, strategy, or agility. Or, that I can overcome a weight-loss plateau by sticking to my same daily fitness routine. If I want different results, I’ll have to change my approach.

The same rules apply in the workplace. As modern marketing and business professionals, it’s illogical to think we can keep up with the pace of marketing in a world where “content is king” and data is everywhere – unless we improve our processes. Being agile is what makes or breaks a company in these new and exciting times.

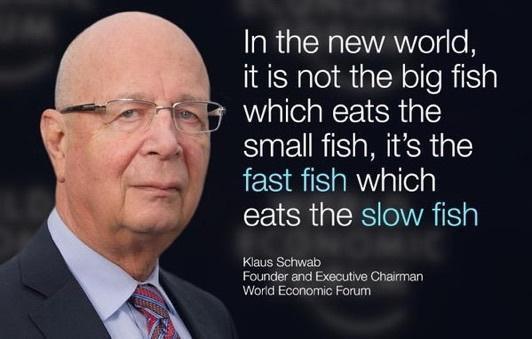

I came across this quote on LinkedIn it literally jumped off the page at me.

Klaus Schwab, Founder and Executive Chairman of the World Economic Forum, said, “In the new world, it is not the big fish which eats the small fish, it’s the fast fish which eats the slow fish.”

In other words, it isn’t the size of the fish; it’s the motion of the ocean.

Firms that are quick to develop and execute an effective marketing technology strategy, regardless of size, have the opportunity to stand out from competitors who are slower to adapt.

According to an REP Independent Broker/Dealer Report Card, twenty-seven percent of advisors named technology as a reason they left their previous broker/dealer. The report stated smaller firms seem to have gained an edge when it comes to serving their advisors. This goes to show that small firms who learn how to swim faster may eventually rule the sea.

An investment marketer’s insanity: Quarter-end production

I’ve learned the definition of insanity for many investment marketers is directly related to the quarter-end production process. This type of deadline-oriented work is highly reliant on a streamlined process, which is not easy to achieve. There are a myriad of factors that can throw the production timeline out of whack. Data problems, documents held-up in review, new funds/products added to the mix, or any number of related issues can cause a delay. Some firms have developed effective strategies to overcome these hurdles, but the vast majority use outdated systems and processes. For instance, copying and pasting data from a spreadsheet into a fact sheet or pitch book template is not the wave of the future. It’s slow, prone to risk, and a waste of your marketing team’s talent. There is a better way, and it can be achieved through effective leadership and a good MarTech strategy.

We recently conducted a study on mutual fund fact sheet quarter-end production efficiency. The report found that, on average, firms publish their first fact sheet on the 11th business day after quarter-end. And because fact sheets are still among the most widely used sales tools in the field, the firms who continually beat this average tend to be more successful.

If your marketing and communication materials are hitting the street after your competitors, it’s probably time to change your approach.

Change your strategy; Change your outlook

The right MarTech strategy is your ticket to success in this new world. A proper strategy creates opportunities to move faster and compete more effectively. However, when it comes to updating and producing investment marketing materials, speed isn’t everything. You must also consider risk. What good is being first to market if your information is published with incorrect or inconsistent data or disclosures? Bad press and/or regulatory issues will have overshadowed all of your hard work. The right strategy will have a data management component at its core.

To determine if your communication strategy might be falling short, you can ask yourself these questions:

Do you have a single source of truth?

Investment marketers rely on quick access to quality, reliable data. In order to achieve data quality, you need a good data management system or process in place that provides immediate access to a single source of clean, consistent, and approved data. For investment management firms large and small, the data is typically the #1 bottleneck in the production process. From a speed and risk management standpoint, creating one source of reliable quality data is the foundation of success. The truth (your data) will set you free!

Are you effectively supporting your sales force and intermediaries?

Does your current approach enable your sales teams to move quickly and sell effectively? The most effective asset managers are getting their marketing and communication materials into the hands of their sales force more quickly and providing the tools for them to create personalized sales materials, tailored to each opportunity.

Is your system scalable?

Take a look at your growth trajectory over the next 12-18 months. Let’s say you grow as expected. Will your current operations scale effectively?

If you can answer “yes” to these questions, you’re in a prime position to compete in the new world. If not, you may need to take a step back and rethink your approach.

Share this post if you liked it! You may also subscribe to our blog to be notified when new posts are published.

Here are some related resources that might interest you: From the Blog: 7 Problems With Automating Factsheets In PowerPoint |  From the Blog: 3 Factors that Complicate Factsheet Automation |  From the Blog: Print is Dead, Long Live Print! |

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]