What’s Driving Asset Managers to Change Their Websites?

The design of your website sends an immediate message to investors and advisors about what kind of firm you are. In addition, web user behavior is evolving, which means your website needs to keep up with the prevailing trends for user experience. Read on for five trends that are driving asset managers to change their websites.

#1 More scrolling, less clicking

Most asset management websites are digital hubs for “information overload”. Because most sites provide a lot of information on a multitude of financial products, they can tend to feel cluttered. It may take a lot of clicking around for visitors to find what they’re looking for, and that could result in higher bounce rates and lower engagement. In our fast-paced world, it’s important to organize your site in a way that makes it easy for visitors to navigate your information. User behavior is changing and visitors see clicking as a chore. Today’s web users prefer to scroll to find and digest information, in logical order, as they move down the page. Users are disenchanted with the cumbersome nature of clicking through and waiting for a page to load. Long scrolling web pages keep visitors engaged and they deliver information in manner much like storytelling.

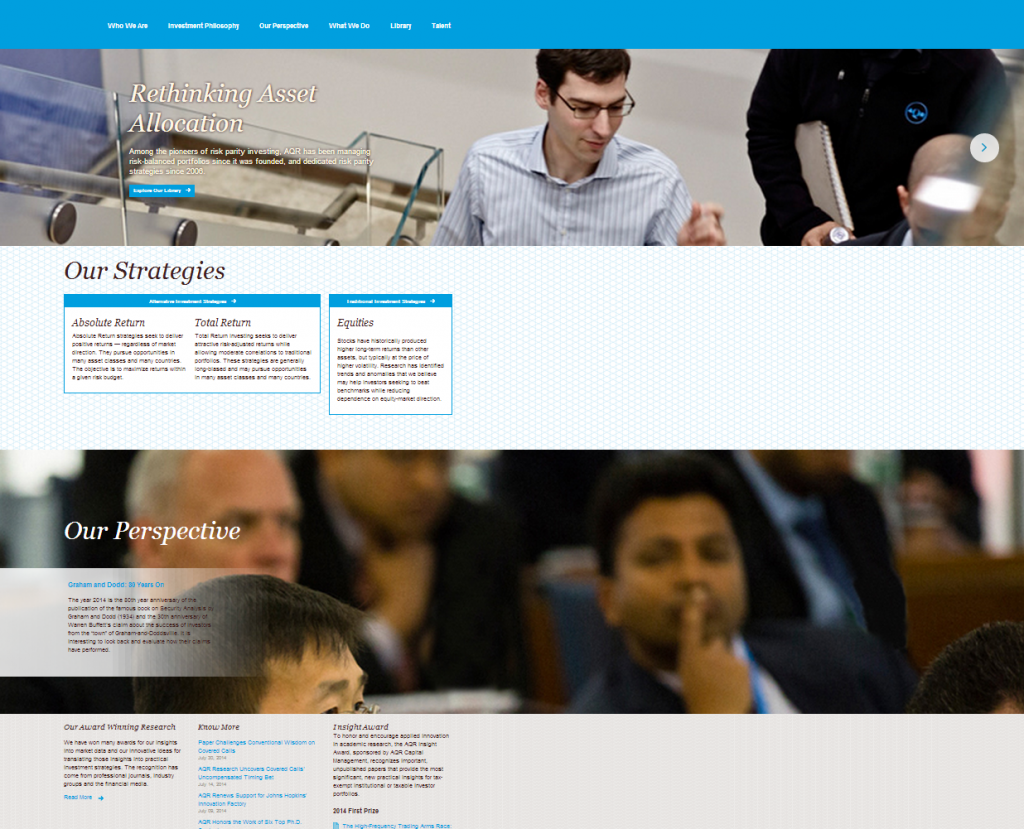

AQR is one asset manager that is doing it right. They’ve embraced the current UX movement by organizing their content using a single-bar navigation structure which invites visitors to scroll. Visitors move down the page to access additional information, rather than using sub-navigation to visit separate pages. Users simply scroll to learn more, drawing them deeper into the content of the site. They’ve also made great use of large images to engage the eye.

#2 Responsive design

According to StatCounter, the percentage of page views coming from mobile phones in May 2014 was 25%, compared to 14% in 2013. In addition, 71% of users access social media from a mobile device. As asset managers continue to expand their content and social media strategies to draw users to their websites, it is increasingly more important to design sites for the mobile experience. This means that firms need to make sure their websites are responsive.

Barclays recently upgraded its site to be mobile-friendly, and even provided a video tutorial for how customers can best take advantage of the changes. The new site design allows users to add interesting items to the “My Collection” tab, so they can be easily accessed later.

#3 Content and social integration

Smart asset management firms are integrating content and social into every page of their websites, providing more value and opportunity for engagement with advisors and individual investors. Researching firms online is the first step in the process for most people. That’s why providing insights and a social presence is more important than ever to gain trust. Having blog content and social media widgets integrated into the main pages of your site will make it easier to find, read, and share your content.

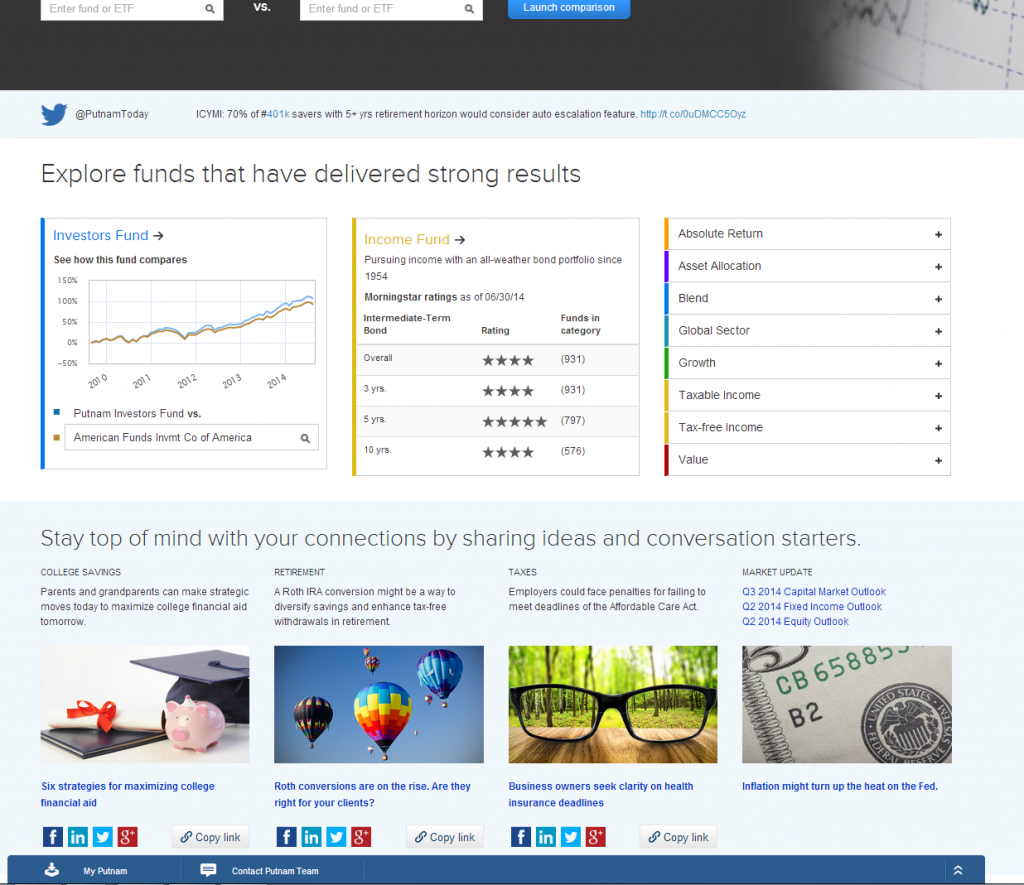

When you visit Putnam Investments’ website, you’ll notice their excellent use of content and social integration which invites visitors to “stay top of mind…by sharing ideas and conversation starters.” Social media buttons are prominent in this section, encouraging readers to share.

You’ll also notice a twitter feed right in the middle of the page. While many asset managers are finally going social, it’s not always easy to find them. The current trend for social integration is embedding widgets into the content of your site as opposed to simply providing social media icons at the top or bottom of the page. The idea is to strategically integrate your social media activity into your pages so that visitors don’t have to hunt for your content or go out of their way to engage with you.

#4 Large, bold images

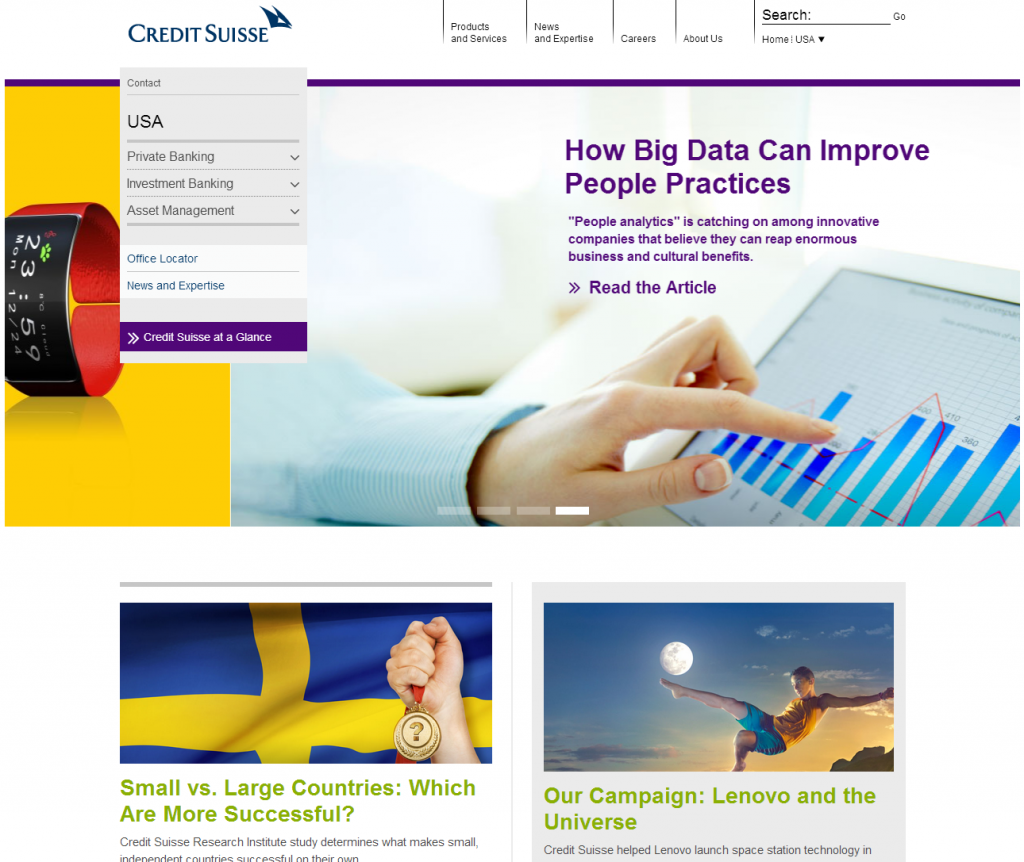

We all know that a picture is worth a thousand words. The way your site looks will either attract or detract visitors from engaging with the content on your site. The latest web design trends call for using large, simplistic images that depict real life. Credit Suisse does a good job of utilizing large, vibrant, colorful images to draw the eye.

Many asset managers are applying this tactic to keep up with design trends. I do see one problem, though. Many asset managers rely on using generic stock photography which can make your brand look, well, generic. Ideally, your web marketing team should create custom images for your website and blog. This will differentiate you from competitors and convey a consistent brand image throughout your website.

Visit Credit Suisse’s website.

#5 Automation strategy

Monthly or quarterly updates to your site can be time-consuming and prone to human error. If you’re not already automating some of your website updates, it’s an option to seriously consider. Automation platforms can support your website in ways ranging from delivering data feeds to full-page or component production. To deliver the most current information to your audience as quickly as possible, you can automate the data-driven areas of your site such as dynamic charts and graphs or the publishing of PDF documents. This will take the load off of your site administrators and streamline the operational management of your website.

While most investment marketing websites are supported by modern content management driven platforms, some fund companies (like Hartford Funds and others) have taken it to the next level. These firms are using a unified data warehouse to drive accurate and consistent data and language content to both their website and to their print (or downloadable) literature. While this strategy may not be apparent in looking at their websites, the reduction in information disclosure risk to the firm is of huge value in the current regulatory climate.

Satisfying both the needs of the digital and traditional marketing organizations off of a single ECM solution is a challenging feat because each medium has unique challenges. Forward-thinking firms are taking full advantage of technology to overcome these challenges and streamline their quarter-end marketing processes.

Conclusion

Different asset managers have unique focuses for their online presence. But at the end of the day, the bottom line is that a good digital presence establishes your firm as an authority, builds trust, and provides a streamlined user experience. If you’re not sure where to start, you can take the approach of BlackRock and survey your website visitors to find out what is important to them:

Thanks for reading! If you liked this article, you can sign up to receive more content like this.

You can also learn more about automating content publishing like fact sheets and custom charts and graphs, here.

Here are some related resources that might interest you:

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]