How Asset Managers Use CDPs To Create The MarTech Stack Of The Future

Guest post by Marianne Hewitt, CEO at The Growth Strategy Group. This article first appeared on cdp.com.

Asset managers must continue to drive down expense ratios and keep an intense focus on growth by leveraging modern technologies and improving operational efficiencies. For asset managers to deploy that technology, they need to invest in the marketing technology (Martech) stack of the future.

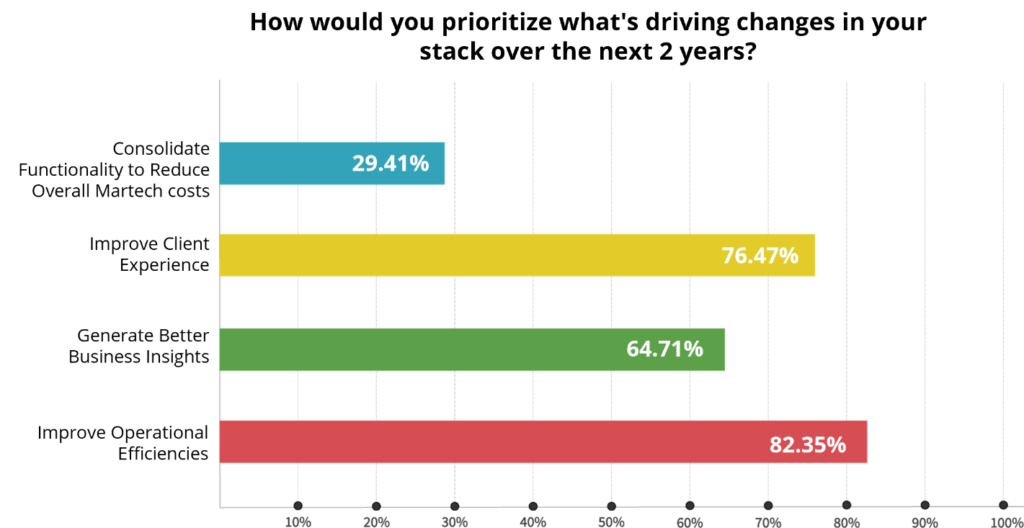

The Asset Management MarTech Stack Insights and Trends research, in which I collaborated with Synthesis Technology and Sondhelm Partners, identified operational efficiencies as the largest influence for shaping MarTech Stacks in the next two years. Delivering an effective customer experience and generating business insights were also priorities that will influence the construct of the future MarTech stack.

What are the investments and innovations needed by asset managers in the next two years, and beyond, to deliver on these priorities? We found:

- Half the participants indicated their systems were not well integrated. Only a small percentage had their compliance review system integrated with their document management system. Sixty percent indicated they should be integrated.

- The most predominant platform used is the customer relationship management (CRM). Less than 15 percent of respondents indicated their marketing automation platform was integrated with their content automation platform.

- Social media engagement was used by half of participants. Boutique asset management firms had little social media engagement.

MarTech Maturity Beyond CRM

The pandemic has taken digital engagement to new levels. Digital engagement will continue to be a large and important part of the customer experience going forward. This will require more mature MarTech stacks and a strong focus on data cleanliness and quality.

CRM has been a mature part of the retail tech stack for some time. But retail’s institutional counterpart is closing the gap by more fully utilizing CRM functionality and improving the quality and quantity of data. The gap in marketing automation persists with distribution using CRMs for marketing tasks like segmentation and targeting client materials.

The really interesting part of the stack analysis is that CRMs (as indicated by the Synthesis survey and a survey conducted by The SME Forum and Ignites Research) seem to have become the single source of truth for all sales activities and beyond (e.g. segmentation, personalization, and predictive).

Institutional is positioned to become more data-driven but has yet to step up to strengthening data governance at the business unit level and use analytics to its maximum.

The MarTech Stack of the Future

What should the MarTech stack for asset managers look like in two years?

Two years is not a long time to reshape a technical architecture and all the applications with which it interfaces. One size does not fit all. Each organization must have an architecture that fits their industry, business and customer needs to deliver a superior customer experience across all channels.

The businesses that have an integrated suite as its core may choose to build on that suite. Businesses that choose a best-of-breed approach will have a different architecture. There are also those that will combine integrated suites (some of which are not really integrated) with best-of-breed for their own hybrid approach.

Future architecture will address all customer information including marketing, distribution, back office and any other business function that has customer interactions. The future marketing technology stack will be customer centric and data driven. It will drive customer acquisition and retention and continue with digital transformation initiatives, including artificial intelligence and machine learning. The future tech stack will be adaptive and responsive to continuous and unpredictable changes occurring in business and technology.

Data Privacy and Governance

Future architecture will also address regulatory compliance and privacy demands through integrated suites or pure-play providers. Privacy continues to be rated as the number one priority of organizations for the near future, and is completely dependent on high quality, clean data.

CRM will continue its role as an anchor, since distribution has a high level of influence in the asset management businesses. But data will become a stronger influencer on the stack as it has in other business sectors. Data continues to be fragmented in asset management. Marketers themselves are downloading data from independent data stores to spreadsheets to conduct marketing campaigns.

The SME Forum survey indicates that over 40 percent of respondents rate their data governance policies as poor. However, the survey also indicates respondents rate the quality of institutional data significantly improved over the last four years.

What Are the Core Capabilities of a CDP?

As defined by the CDP Institute, a CDP must be software from one vendor with a unified customer database that enables several core capabilities that are considered must-haves to be considered a RealCDP.

A CDP must have the ability to:

- Ingest data from multiple sources

- Create customer profiles that remain indefinitely and can be augmented

- Be accessed by other systems

Integrating CDP Into the MarTech Stack

CDPs solve the integration problems that exist in asset management technology environments. These are often complex legacy environments which are prime candidates for operational efficiency. Each vendor’s CDP offering is different beyond the core capabilities.

Customer Data Platforms (CDPs) will be an option for many asset managers to centralize data (the buy option).

Some asset managers will choose to develop a proprietary customer datastore (“build”) that serves as the single source of truth for all things customer. It can be shared by all functions in an asset management company.

Other asset managers may choose to license (“buy”) a CDP and still have a proprietary environment for data and use cases that can deliver competitive advantage for some specific strengths of that asset manager. This option is a blend of “build” and “buy”.

Ingesting and distributing out are core features of a CDP. Using the CDP as the central hub for ingesting data and distributing it can be a positive contributor to increasing operational efficiency.

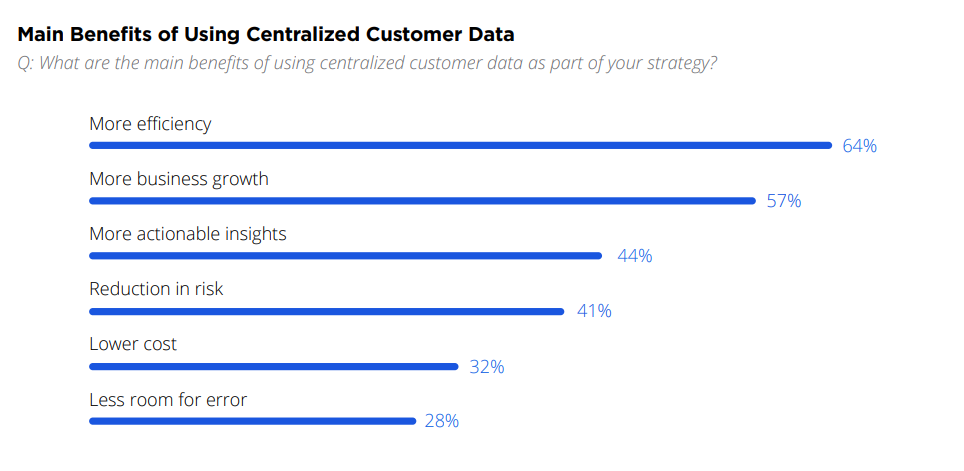

In Treasure Data’s recent Customer Data Maturity Survey, 64 percent of survey respondents identified operational efficiency as the most beneficial reason for centralizing customer data.

The Journey to New MarTech Architecture — It’s All About Data

Centralized customer data is the key ingredient for memorable customer experiences, regulatory and privacy compliance, and innovation for asset managers.

The journey to the MarTech stack of the future begins with a customer data strategy including a first-party data strategy. If a formal data governance program is not in place, initiating one with executive sponsorship will be essential to long term success.

The journey continues with the identification of use cases that are needed to execute business processes. These use cases are the deciding factors in a build or buy decision on the platform used for housing and processing customer data.

If a “RealCDP” is decided upon, the type of CDP selected is based on the use cases required and potentially features that are inherent in the CDP that can replace free-standing software/SaaS, contributing to more operational efficiencies. A CDP can potentially solve many of the integration problems that exist today.

Operational efficiencies, growth and innovation with a dash of agility and a touch of strategic thinking will bring asset managers to a future-proofed MarTech stack with the ability to adapt to continuous change in a digital world.

Guest post by Marianne Hewitt, CEO at The Growth Strategy Group. This article first appeared on cdp.com.

Here are some related resources that might interest you:

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]