Category Archives: FinTech

Build or Buy: How to Decide?

When looking at content automation and sales enablement solutions, firms are often confronted with a tough decision: To build or buy? Over the past 20 years, I’ve participated in many of these discussions and seen it go both ways. Sometimes the decision is successful and other times it ends up a costly mistake. On one hand, it isn’t always less expensive nor less risky to build software as opposed to buying commercial solutions. For example, when application development projects are initiated with the intent of justifying and maintaining the technology team. Then, unfortunately, they never get off the ground because they can’t be supported technically or economically. What then happens, after all the internal effort and expense, is a new commercial solution is procured to replace it.

On the other hand, sometimes the technological or business needs are so pertinent to operations that they cannot be outsourced. In these circumstances, there’s a good case for insourcing as opposed to outsourcing if the board of directors approves. Also, the IT organization must be truly committed to the budget and vision. At the end of the day, the success or failure of development efforts should be measured against the same criteria. When weighing the decision to build or buy, I recommend using these six criteria:

The 3 Ways to Approach Content Automation

Due to the competitive nature of the financial services industry, content automation has become a strategic priority for many. With a finish line goal to improve scalability, risk management and brand compliance, the race is on to improve marketing and sales operations. The challenge firms face is knowing how to approach content automation. Is it better to build or buy? What are the differences between the leading vendors, and their approaches?

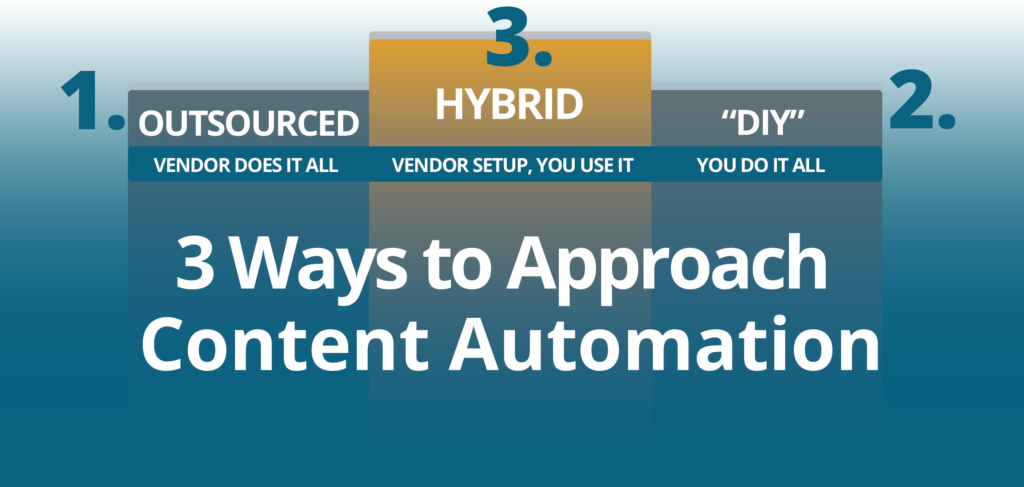

In 2017, we commissioned some research on how asset managers are automating content production. The research found 3 common models: Fully outsourced, DIY, and hybrid. Here’s a brief description of each and the pros and cons.

How to Prep your Team for Content Automation

As Ben Franklin once said, “By failing to prepare, you are preparing to fail.”

Preparation is critical to the outcome of a content automation initiative. There’s always a possibility implementation will go awry if the project plan is disorganized. Organization and planning are challenging, for it takes specific business and leadership skills to run this kind of technical project. Many departments need to get involved, including marketing, IT, sales, and compliance. Stakeholders from each department must re-examine their processes and work together to re-create them for automation. The goal is to improve the process fundamentally and permanently within the boundaries of a systemized solution. More often than not, this is easier said than done, and may require professional assistance. Here are 5 best practices to prime your team for content automation.

Q&A Discussion: Blending Marketing Customization & Compliance in Financial Sales

In the heavily-regulated world of investment management, consistency and harmony between functional areas, including marketing, sales and compliance, are key goals for competitive advantage. However, blending customization and compliance is difficult to achieve.

Many disconnects happen at investment companies when marketing creates collateral which, from the sales perspective, misses the mark on client-focus and relevance—all before a compliance review. Ultimately, in the name of making the sale, salespeople customize presentations, creating multiple versions along the way that are difficult to track. This unwieldy process can cause compliance, branding, and messaging nightmares that may lead to fines, outflows, and lost revenue.

Firms are almost always aware that these disconnects exist and want to fix them, yet don’t know where to start. We recently held a webinar; The Sales Success Formula in Financial Services: Blending Customization and Compliance, to discuss this very topic. It was a Q&A session moderated by investment marketing expert Andrew Corn of E5A Integrated Marketing and explored the ways in which firms are using digital transformation to disrupt the status quo and gain competitive advantage.Read More

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]