Category Archives: Marketing Strategy

Using Automation to Fuel Investment Marketing Programs

Many factors influence the volume of content that asset managers produce. Some, such as the merging or closing of funds, help to alleviate the production burden, but most continue to expand the demands placed on marketing units. In a recent study of asset managers, we asked about their marketing processes and use of automation to fuel marketing programs.

3 Ways Asset Managers Will Fail to Differentiate in 2021

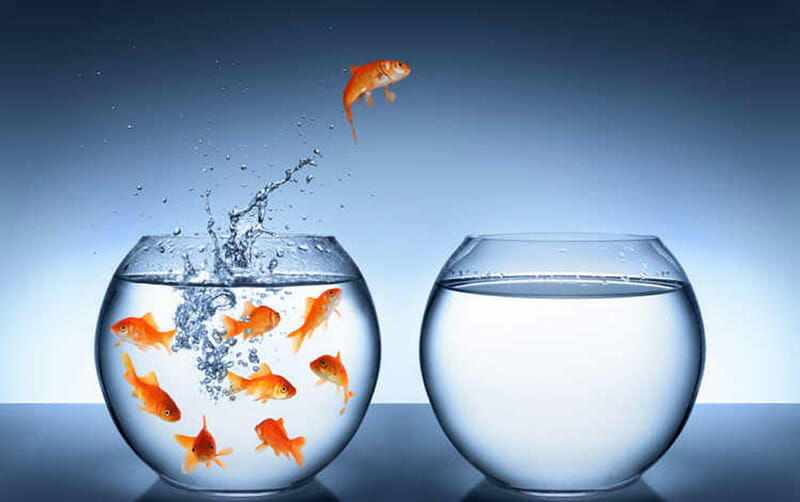

Growing asset management revenues is much harder than it used to be. The number of asset managers and strategies have proliferated in recent years. However, the number of consultants has shrunk, leading to a notable decline in available mandates. In this fiercely competitive marketplace, even firms with a solid track record of performance will struggle. Asset managers which master the marketing process and effectively differentiate themselves will be triumphant in 2021.

Each year, I check in with my network of industry experts to get a pulse on the trends and best practices in asset management marketing. The upcoming year will be marked by big changes in the way marketers develop and deploy their plans. Largely, this is due to the pandemic and a shift to digital. With everyone “going digital” with their content, events, etc…, it’s going to be harder than ever to rise above the noise. Recently, I met virtually with three experts in investment management marketing. I learned what asset managers should avoid if they want to differentiate and gain assets in the coming year. Here are three things asset managers should avoid if they want to differentiate in 2021.

Put Clients at the Center of Your Business — and Your Tech Stack

The pandemic ushered in a new age of technology in the investment management industry. Even firms that had been resistant to digitalization became suddenly, and acutely, aware of existential business risks that could be managed only through digital means. Investment management marketing teams began taking a hard look at their tech stack. A surge of quick pivots followed as firms scrambled to adopt new tools, change processes, and streamline operations to ensure business continuity.

These adaptations are particularly crucial for preserving relationships between advisors and wholesalers. According to research from Broadridge, 22% of advisors found wholesalers to be less helpful during the pandemic, and 32% have decreased their reliance on wholesalers over the past two years.

3 Ways Investment Marketers Have Adapted in 2020

The status quo is no longer good enough for intermediaries and investors. Investment marketing strategies have and will continue to shift since the COVID-19 pandemic. Then again, if you’re a forward-thinking marketer, I didn’t need to tell you that.

Synthesis and Evalueserve recently kicked off our quarterly private marketing roundtable series. We met with senior marketers from top investment management firms. Marketers shared their experiences, challenges, and ideas for success in our post-Covid environment. Since the pandemic, managers are figuring out how to step up their game to deliver customized and timely information to investors. So, marketers are reevaluating sales and marketing initiatives to remain competitive in a digital world. What does digitization mean for asset management marketers, and how can they efficiently achieve this? Marketing departments need the strategies, tools, and resources necessary to enable sales teams for success.

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]