Category Archives: Compliance

Q&A Discussion: Blending Marketing Customization & Compliance in Financial Sales

In the heavily-regulated world of investment management, consistency and harmony between functional areas, including marketing, sales and compliance, are key goals for competitive advantage. However, blending customization and compliance is difficult to achieve.

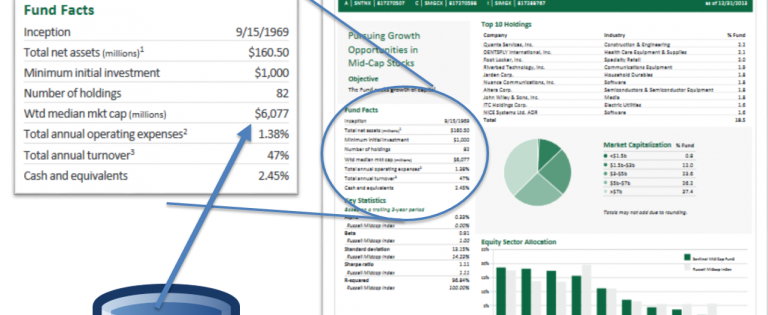

Many disconnects happen at investment companies when marketing creates collateral which, from the sales perspective, misses the mark on client-focus and relevance—all before a compliance review. Ultimately, in the name of making the sale, salespeople customize presentations, creating multiple versions along the way that are difficult to track. This unwieldy process can cause compliance, branding, and messaging nightmares that may lead to fines, outflows, and lost revenue.

Firms are almost always aware that these disconnects exist and want to fix them, yet don’t know where to start. We recently held a webinar; The Sales Success Formula in Financial Services: Blending Customization and Compliance, to discuss this very topic. It was a Q&A session moderated by investment marketing expert Andrew Corn of E5A Integrated Marketing and explored the ways in which firms are using digital transformation to disrupt the status quo and gain competitive advantage.Read More

What’s Driving Asset Managers to Automate Pitchbooks?

Why automate pitchbooks? Asset Managers recognize automating the marketing and sales process is required in order to be efficient, compliant, and competitive. The manual process of updating pitchbooks and distributing them to the sales force is an antiquated process. It doesn’t adequately serve salespeople or their clients and prospects. There are four main drivers influencing asset managers to automate this process:Read More

5 Mistakes Asset Managers Make When Managing Disclosures

Managing disclosure language has been a critical element of Synthesis’ document automation approach for over two decades. Even with modern technology and processes, disclosures continue to be a pain point for most asset management firms. Recently, we’ve been doing research into the processes asset managers use to manage their disclosures. The goal of this research is to better understand why disclosure management continues to be problematic. Through our discussions with marketing and compliance professionals at large and small investment management firms, we’ve been digging into how firms create, edit, distribute, and retire disclosure language — and what the major issues are.Read More

Business Rules: What They Are and Why You Need Them for Investment Marketing Content Automation

Hi, I’m Kim Rebecca. Throughout my career in the global asset management industry, I’ve had the opportunity to help facilitate data-heavy content automation. I’ve done this on thousands of regulatory documents, marketing collateral, presentations, web pages and so on. Actually, it’s probably hundreds of thousands. One of the key advantages of content automation is the accommodation of the ever-expanding scope of distribution. It allows product marketers such as myself to bolster their bragging rights. I’ve had the good fortune to help three global asset managers with their content automation efforts — prominent and well-recognized firms managing assets galore. I was thus somewhat surprised to find that a common challenge in the implementation phase of all of their automation was something seemingly basic: the identification and articulation of something called business rules.Read More

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]