Content Automation: A Competitive Necessity

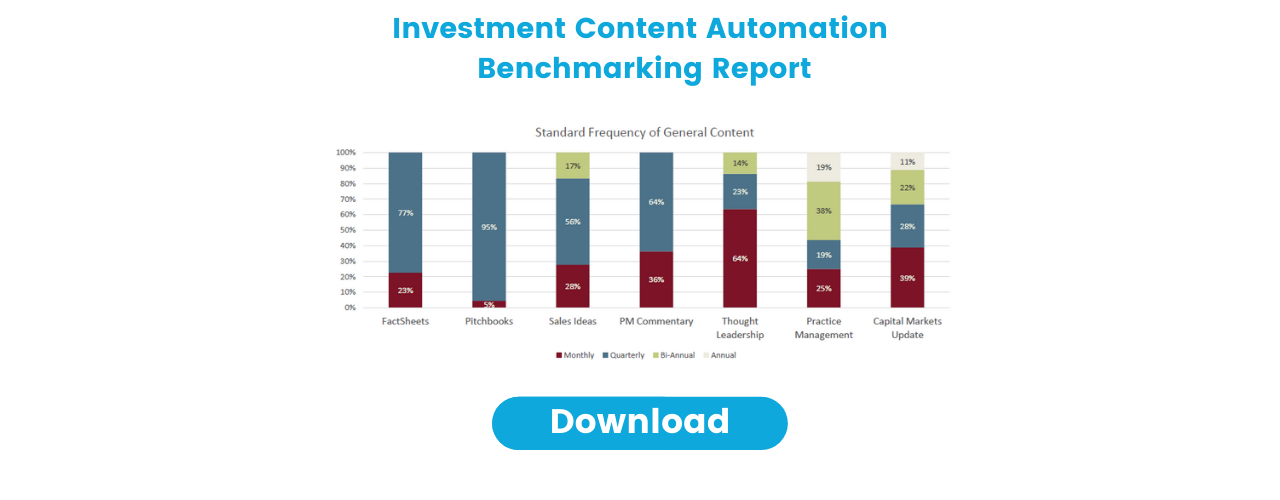

Content automation has become a necessity, rather than a luxury, for most asset managers in today’s highly competitive environment. According to a survey of asset managers by the Fuse Research Network and Synthesis Technology, 95% of respondents use some kind of tool or process for automating content production. Most commonly, they use it for the creation of factsheets and pitchbooks.

The need for content automation is justifiable. Marketers need to get sales and marketing materials in the hands of salespeople, clients, and prospects as fast as possible. Now, investors, advisors, and consultants expect more frequent and timely product updates.

When implemented successfully, content automation solutions empower firms to produce fully compliant, client-ready sales and marketing content faster than their competitors. These tools reduce labor costs and relieve talented marketing professionals from the drudgery of content production. They minimize the potential for human errors that inadvertently deliver inaccurate and non-compliant information to the public. Plus, they eliminate one of the most common compliance headaches many asset managers face: keeping salespeople from stitching together their own non-compliant pitchbooks from a patchwork of outdated sales presentations.

Effective content automation solutions require two components: An in-house or commercial production tool and a reliable source of product data to populate the finished pieces. Unfortunately, data management is content automation’s Achilles heel for many firms.

Related Whitepaper: 8 Data Best Practices For Investment Managers

According to the benchmarking report, 46% of the data asset managers use in sales and marketing materials is imported from internal databases and 27% is entered manually. Considering the many challenges firms face in collecting, validating, reconciling, and distributing data coming from different internal and external sources, it shouldn’t come as a surprise that 43% of survey respondents cited inefficient manual data management processes as the single biggest obstacle keeping from meeting their content distribution deadlines. And just 25% are fully satisfied with the way their firms manage their internal data warehouses.

When asset managers fail to address data management challenges, it results in unacceptable delays in getting content to the market and increases their distribution of inaccurate or non-compliant materials to the public. So, it’s critical for asset managers to evaluate their data management strengths and weaknesses before choosing a content automation solution provider—or developing these capabilities in-house.

Three Content Automation Models for Asset Managers

Over the past five years, there’s been an explosion of software companies claiming to offer content automation. Even Adobe and Quark jumped on the content automation train. Now, asset managers must wade through the enormous sea of options to determine the best solution for their firm. Through our conversations with asset managers, we’ve identified 3 ways most firms approach content automation: the “Do-it-Yourself” model, the “Outsourced” model, and the “Hybrid” model. Each has its benefits and potential drawbacks.

The Do-it-Yourself Model

Some firms build their own content automation solutions in-house. The main benefit of these homegrown solutions is that asset managers have total control over application development. This enables them to create a fully customized solution that aligns with the needs of the sales and marketing users.

Two ways this can be done are with proprietary tools, or by porting data into Adobe InDesign or Microsoft Word or PowerPoint templates.

Many firms buy “DIY” software that relies on the data linking and embedding features of Microsoft Office to automatically import data from Excel spreadsheets or databases into Word documents and PowerPoint presentations. There are several software companies that provide content automation solutions built around Microsoft products. The idea is that the firm can buy the software and then set it up themselves. This requires ample in-house skills and resources, as well as a strong data management strategy and process.

The potential risk of building a solution from scratch is that completing it may require months or years of work from a dedicated development team.

Along the way, key members of the team may either be reassigned or join another firm. Even if the development goes smoothly, the finished application may not offer best-in-class capabilities. If the interface is difficult to use or if the content it produces is anything less than fully accurate and compliant, users won’t trust it.

The Outsourced Model

Many asset managers that don’t have large marketing production teams choose this model. They’ll generally hire an agency or other third party to take their data feeds and files and update design templates. The outsourced provider may do this manually or in a semi-automated way.

The biggest drawback of this model is the lack of control to make changes directly, along with the potential for slower turnaround times. In a truly outsourced scenario, there is not a user interface for the marketing team to participate in the process. They must wait for drafts to arrive, then approve or request changes to the materials. There are back-and-forth review cycles until the content is approved for distribution.

The Hybrid Model

In this scenario, the asset manager gets the best of both worlds. The implementation is outsourced, but the ongoing content updates are handled by automation software that marketers have direct access to. The vendor will provide a turnkey implementation that is fast and accurate. This helps get the asset manager up and running quickly and seeing an ROI on the solution very quickly.

With a turnkey implementation, the vendor takes on the work of aggregating and linking the data, as well as setting up the design templates and business rules. Once the automation solution is set up and tested for quality, the system automatically populates the content when new data is uploaded or fed-into the system. The data is presented consistently across websites, factsheets, pitchbooks, consultant databases, and other media. Marketers can participate, through a user interface, in detecting and fixing data, copy, and design issues as they arise.

There are, however, certain tradeoffs for choosing the hybrid model, including up-front expenses for initial implementation costs and ongoing maintenance. And asset managers who are partial to building in-house may not embrace the idea of outsourcing the implementation.

When comparing the total cost of ownership (TCO) between DIY and Hybrid solutions, hybrid models generally cost less over time. This is because the total cost of a DIY solution includes the additional marketing and IT staff and, in some cases, outsourced consulting and implementation. DIY software is a heavy lift and resource burden on internal teams. So, while the Hybrid model may look more at the outset, it’s important to calculate the TCO when comparing different approaches.

Core Competencies

In addition to the type of approach, marketers must also consider the core competencies of the vendors they’re considering for content automation solutions. While the number of providers has increased dramatically, not all of them have a core competency in content automation, and not all are purpose-built for automating data-heavy investment marketing content.

Top Content Automation Providers For Asset Managers

As mentioned above, the content automation industry has exploded with options, making it challenging for asset management firms to evaluate and choose the right solutions. Here’s a summary of some of the industry’s leading providers.

1. Synthesis Technology

Model: Hybrid

Core Competency: Content Automation

The Synthesis solution was purpose-built for investment companies and 100% of the client base is investment management firms. Our integrated automated investment data management and content automation solution offers best-in-class capabilities for asset managers who need to deliver accurate, compliant, client-ready sales and marketing materials to investors as fast as possible.

Synthesis’ content automation capabilities are underpinned by our data management engine, bringing data governance and quality into the product marketing process. It automatically cleanses and validates all incoming data and notifies data owners if a manual review is required. Once validated, data is mapped to predefined “components”—specific data sets such as holdings, performance metrics, charts, fee tables, and even disclosures.

Users can then use the user-friendly, web-based content automation tool to instantly incorporate these components into pitchbooks, factsheets, prospectuses, commentaries, or their websites. Synthesis’s rules-based workflow ensures that standard disclosures are automatically inserted where required. Whenever new data arrives or disclosures are added or changed, these components are instantly updated. Therefore, users never have to wait to deliver the most current information to their clients and prospects.

Synthesis typically implements a solution within 90 days. There is a fee for implementation, as well as ongoing services. Every client is assigned a dedicated client service team, including a Project Manager and automation specialists.

2. Seismic Software

Model: DIY

Core Competency: Sales Enablement

Seismic Software is well known as a provider of sales enablement tools. It’s also become a dominant player in the content automation industry. Seismic’s LiveDocs platform is used for producing factsheets, pitchbooks, and other data-linked content.

According to their website, Seismic can integrate data coming from an asset manager’s data repositories, CRM systems, and marketing automation tools into its integrated sales enablement and content automation platform. This enables salespeople to use LiveDocs to generate highly personalized content on the fly and distribute it to targeted audience segments or individual clients and prospects. Content is produced in Microsoft Word and PowerPoint formats.

Seismic does not have built-in data management capabilities and the implementation is not included in their out-of-the-box offering. Asset managers collect, calculate and validate data themselves and then send it to Seismic to update the data-linked documents. Firms should consider the cost of implementation as well as the platform and user license fees when calculating the Total Cost of Ownership (TCO). Specifically, this means hiring more internal staff with the right skillsets or vetting and hiring a third-party consultancy with experience implementing Seismic.

3. Kurtosys

Model: Outsourced or DIY

Core Competency: Website Design and Automation

Kurtosys is mostly known for building asset manager websites. However, the firm also offers content automation capabilities.

Its signature WordPress-based website platform makes it easy for asset managers to build a more compelling online presence. The firm’s content automation tools can instantly update fund information on these clients’ websites and generate Word and PowerPoint-based presentation factsheets and other documents.

Historically, Kurtosys has offered content automation as an outsourced service using InDesign templates but has moved to a more self-service, or DIY model in recent years. According to their website, Kurtosys allows users to build their own templates in InDesign, Microsoft Word, and Microsoft Powerpoint.

4. SimCorp Coric

Model: DIY or Hybrid

Core Competency: Client reporting

Based in Denmark, SimCorp is a leading provider of portfolio management software in Europe, and its U.S. presence is growing. SimCorp’s Coric content automation platform is primarily known for its ability to generate a wide variety of highly customizable client investment reports. Also, it offers salespeople the ability to create pitchbooks, factsheets, and other marketing materials populated through incorporating updated and accurate data.

SimCorp positions itself as a provider of portfolio management tools built on a core competency of data management that’s designed to create unified data flows and enable the re-use of materials across an enterprise.

Historically, SimCorp Coric has been deployed in-house as a turnkey, do-it-yourself software solution. SimCorp provides extensive training to enable its clients to operate and manage the application on their own without extensive outside support. However, SimCorp now also offers Coric as a cloud-based managed service hosted on Microsoft Azure. Some users believe that this hybrid solution generates better marketing output than Coric’s do-it-yourself deployment.

5. FactSet’s Vermillion Software

Model: Hybrid

Core Competency: Client Reporting

FactSet’s Vermillion content automation solution is most well-known for its ability to produce detailed, customizable client reports that integrate an asset manager’s internal data with portfolio analytics provided by FactSet. Vermillion can also produce fund fact sheets and pitchbooks in Word, PowerPoint, and PDF formats.

Asset managers collect data from internal and external sources and validate it themselves before delivering it to FactSet. Alternatively, they use FactSet’s automated data management services to handle data uploads and calculations before incorporating it into Vermillion.

One unique feature of the FactSet solution is its ability to automatically create portfolio and market commentaries using Quill, a natural language generation platform. This allows portfolio managers and marketing leads to automatically incorporate this content into standalone articles, client reports, and sales presentations.

Choosing the Right Content Automation Solution

There’s no “one-size-fits-all” solution and every vendor has a core competency. Before you select a provider, figure out who will use the tool and what kinds of content it should produce. Also, identify who will ultimately be responsible for making sure the data which goes into the application is accurate.

To steer you on the right path, we suggest you think about these issues.

- Can your firm quickly and accurately collect, calculate and validate all your data internally? If yes, an outsourced or DIY provider may offer the most cost-effective solution. If no, a hybrid provider that can also serve as your firm’s automated data warehouse may be the best choice.

- Do you have the internal resources and expertise to implement a content automation solution? If not, firms may find that outsourced and hybrid models are better suited for their situation. Firms with ample internal resources with the right experience and skills might prefer a DIY approach.

- What kinds of sales and marketing content do you want the tool to produce? Most platforms produce pitchbooks, factsheets, commentaries, and other documents. Not all can automatically update your website content. Carefully consider the scope of work and what the software can do.

- Do you need the tool to automatically generate client reports? If so, choose a provider that offers both automated client reporting and marketing content production capabilities.

- Does your firm allow the use of Cloud-based applications? Most solutions are web-based applications. However, choices will be limited if your security protocols don’t permit data to be accessed or stored outside your office.

Consider these before you start reaching out to content automation solutions providers. That way, you’re limiting your choices to providers whose capabilities fully align with the needs of your firm.

Here are some related resources that might interest you:

Compare the Top 3 Finserv Content Automation Vendors [White paper]

Compare the Top 3 Finserv Content Automation Vendors [White paper] Create Pitchbooks the Drive Sales [White paper]

Create Pitchbooks the Drive Sales [White paper] Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]

Build vs. Buy: Should Your Financial Services Firm Outsource or Insource Marketing Technology? [White paper]  10 Tips for Rebranding your Fund Marketing Documents [White paper]

10 Tips for Rebranding your Fund Marketing Documents [White paper]